Highlights and Insights From the Prestigious Geneva Watch Auctions

Unveiling the Luxurious World of Rare Timepieces and Analyzing Auction Performances of Renowned Brands

The Geneva watch auctions represent one of the most prestigious and iconic events in the world of luxury watches. Geneva, in Switzerland, is considered the global capital of high-end watchmaking, hosting some of the most renowned watch manufacturers worldwide. The watch auctions in Geneva are special occasions where collectors, enthusiasts, and investors come together to participate in auction sales of unique, rare, and historically significant timepieces.

Just a few days after the conclusion of all events, we have collected and analyzed the results of the main auctions to provide a summary overview of the sales performances. The analysis is divided into three distinct sections that allow for studying the same database from different perspectives, thus leading to considerations about the entirety of the involved parties, from individual auction houses to the brands that played a prominent role.

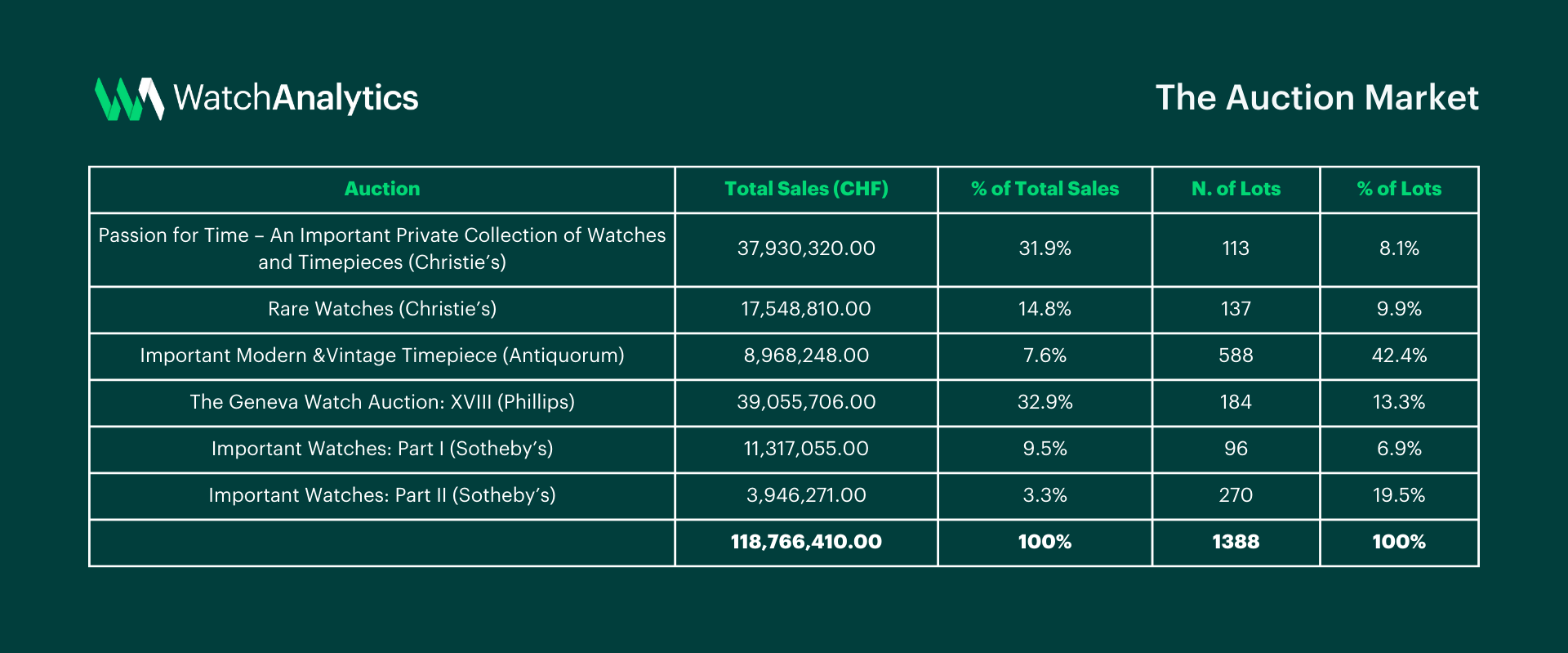

The Auction Market

The first section of this analysis focuses on the overall values generated by the sales and aims to evaluate the performance of the examined auction houses: Phillips, Christie's, Sotheby's, and Antiquorum. For each sales session, the total generated value and the overall number of lots offered are reported.

This week of auctions recorded a total sales amount of CHF 118,766,410.00 with 1388 lots offered. Christie's was the only auction house to organize two separate events: 'Rare Watches' and 'Passion for Time,' a themed auction that featured one of the most extraordinary and comprehensive single collections of watches formed in the last 40 years. It pays homage to the passion, dedication, and determination of a single collector from the Sultanate of Oman, Mohammed Zaman. It is the latter auction that marked the highest ratio of total sales to the number of lots: with only 8.1% of the lots in total, it accounted for 31.9% of the total sales value. This result, combined with that of 'Rare Watches,' establishes Christie's as the auction house that generated the highest total sales value. However, another outstanding performance is that of Phillips' 'The Geneva Watch Auction: XVIII,' which, representing 32.9% of total sales (translated to CHF 39,055,706.00), stands as the most lucrative single auction of the weekend.

Brand Performance

The second part of this analysis focused on the study of aggregated sales data by brand across the six auctions mentioned above. The processing of sales prices allowed us to identify the top 10 brands by total generated value, for each of which we reported the number of lots sold and the respective average selling price per watch.

At the top of the ranking of brands that have recorded the best sales performance is Patek Philippe, with a total generated value approaching 40 million CHF. This figure, representing 33.4% of the total sales value, was achieved not only due to the prestige of the offered watches but also because of the high presence of this brand in the auction catalogs (20.6% of the total watches offered). While it's not surprising that Rolex was the most frequently offered brand during the auctions with a total of 338 lots, what stands out is the total value of 28 million CHF and, especially, the average selling price of 85,078.22 CHF, higher than that recorded for brands like Audemars Piguet and Vacheron Constantin.

Other remarkable results are those achieved by Philippe Dufour and George Daniels, who collectively accounted for 10.6% of the total sales value with only 7 watches sold. This once again underscores how the world's most significant collectors spare no expense to acquire a timepiece crafted by these two independent watchmakers.

Overall, the brands included in this ranking covered 89.4% of the total value realized throughout the week, representing only 65.2% of the lots offered. This gap highlights the concentration of collectors' interest on these watches.

Watches Sold for More Than 1 Million CHF

In this final section, we have compiled the lots that recorded the highest sales values, identifying in descending order the 13 watches that exceeded the price of 1 million CHF. Once again, Patek Philippe and Rolex are the most prominent within the ranking, followed by the masterpieces of George Daniels.

The top spot in this autumn session goes to the price of 5,127,000.00 CHF achieved by Christie's for the sale of the Grande & Petite Sonnerie No. 1, one of the most important and historically significant highly complicated independently made wristwatches of the 20th century. It is the world's first Grande and Petite sonnerie striking minute repeating wristwatch and the very watch that immediately propelled Philippe Dufour to the forefront of independent watchmaking. The second place is occupied by the world-famous Rolex GMT-Master worn by Marlon Brando during the filming of Francis Ford Coppola’s iconic 1979 movie ‘Apocalypse Now,’ and finally, in third place, we find the third specimen ever to appear on the market of the noblest of all Nautilus models, the platinum 3700, sold by Phillips.

Although these prices may initially seem dizzyingly high, the last column of the table highlights how, in the majority of cases, they failed to exceed the maximum estimate provided by the respective auction houses before the sale, recording average prices lower by 30.5%.

Despite the excellent performance of some models, the season was characterized by generally moderate or even lower-than-expected prices. This trend was already evident with the most hyped watches of the last season, six months ago. During the May auctions, there was a marked decrease in the prices of such watches, marking the advent of a new reality in the industry. Currently, we observe a similar trend in the world of independent watchmaking, with brands like F.P. Journe and Voutilainen. However, despite this, these brands continue to generate significant interest due to their reasonable retail prices, which are still below recent auction valuations. Although some models have experienced a decrease of about 35%-40% compared to their historical highs, their value remains significantly higher than primary market selling prices.

Related posts: