How Cryptocurrencies and Auctions Affect the Watch Market

The watch market could be strongly correlated with the cryptocurrencies and also have rising returns during the November Geneva auctions

Often among the messages that so many of you send us, one of the most frequent requests is to recommend watches that might increase in value in the future.

We always answer all these questions in much the same way, namely that no one knows what might happen in a market as full of fluctuations as the watch market has been in recent years.

We experienced a moment of growth that seemed unstoppable, then a very rapid collapse and finally a stabilization phase, all in a very few years.

Through our work in this blog, on the website and on Instagram we try to provide you with a wide range of qualitative and quantitative tools to guide you in this sector, leaving the final judgment of how the market will move to you.

Therefore, in this article we try to analyze some patterns that have occurred in the past and may occur in the future.

Cryptocurrencies

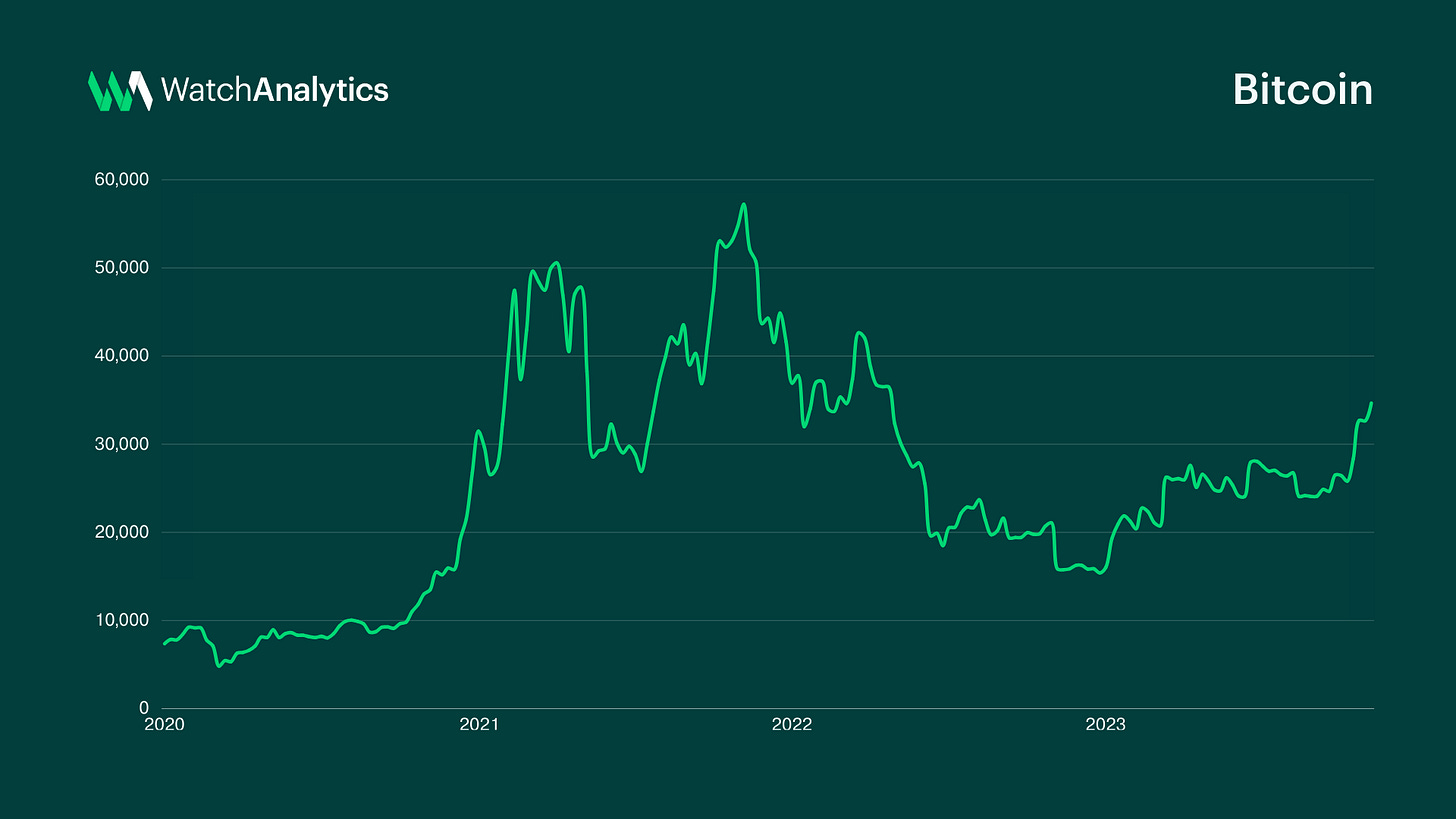

A first element to consider is a potential correlation with the world of cryptocurrencies.

During 2022, just as the watch market was plummeting, Chrono24 stated that one of the triggers for this price reduction was due to the cryptocurrency collapse that was occurring right around that time.

Taking the most identifiable cryptocurrency of all, Bitcoin, as a reference, we cannot but notice a very great similarity with the performance recorded by the watch market: growth until 2022, collapse and stabilization in 2023.

These two markets can be strongly connected in that all investors who made big profits from trading cryptocurrencies then tried to diversify their assets by investing in watches since they were in one of the markets that was performing best at that time.

Then, when the crypto market slowed down sharply in 2022, these individuals who were potentially still exposed with large positions in order to get back from their losses began to liquidate the watches they had purchased. The increase in the supply of watches for sale by these parties was an additional that factor that would exacerbate the situation by helping to push timepiece prices lower and lower during the spring of 2022.

Now, however, Bitcoin, and consequently so many other cryptocurrencies, are returning to growth with rates rising very rapidly in recent weeks, and this could generate some changes to the watch market as well.

Seasonality

There is always a period from Geneva Auction Week in November to Watches&Wonders, where most of the major watches experience periods of growth.

Auctions are a big occasion when the attention of so many enthusiasts inevitably focuses on the prices that lots fetch. All this brings the market back to the center of the great hype that these events bring.

Add to this the fact that spring next year is getting closer and closer, which means only one thing for every enthusiast: Watches&Wonders.

During this event, the maisons present their novelties and as a result some models are taken out of production. This turn over is of particular relevance to the market and often rumors in the months before significantly influence prices especially of watches that are most likely to be discontinued.

As can be seen from the Pepsi curve, going to look at the period between July 2022 and early 2023, we see a rather substantial rebound in the price.

In those months, the price of the watch achieved positive performance for a period despite the fact that those were the months where much of the market was crashing instead.

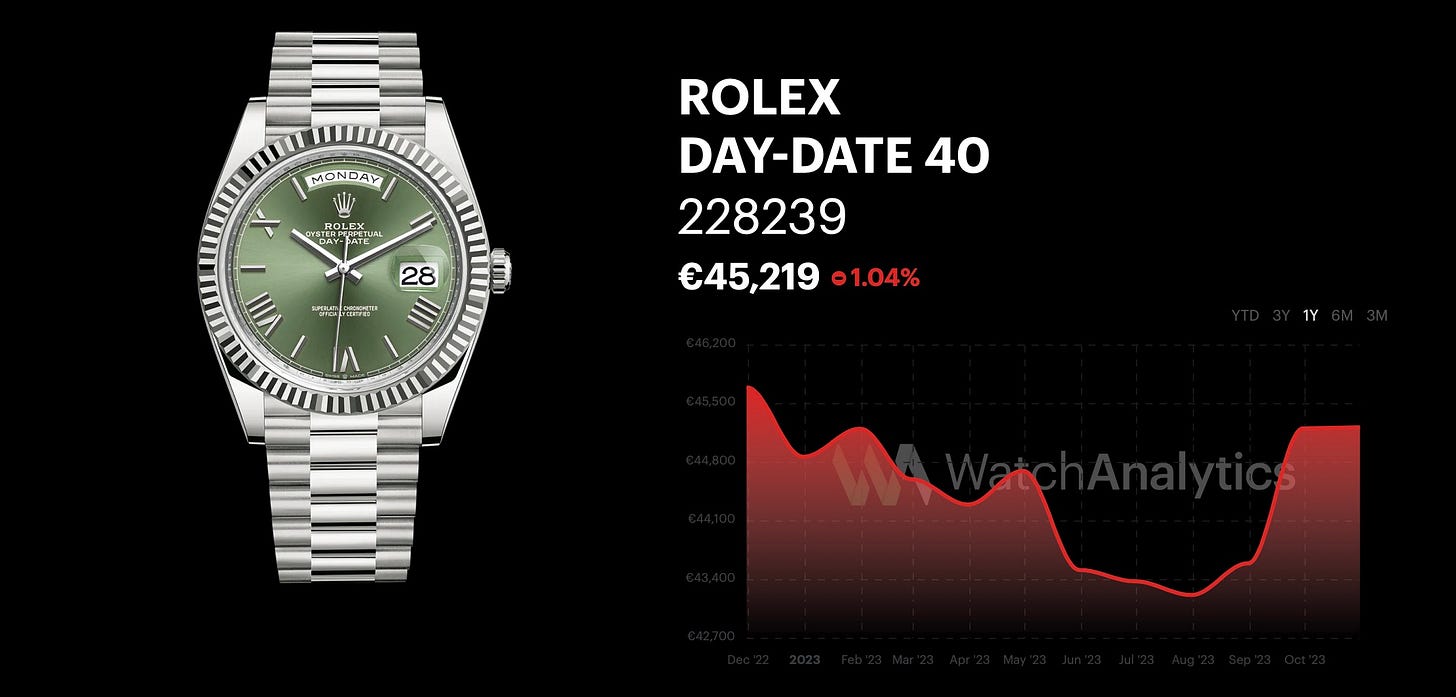

This market pattern is also confirmed by what is happening today with some models such as the Daytona and Day-Date that you see in the picture.

In the first you can see how in the last period the price has returned to rise after a rather negative period during the summer. In fact, the value is up in 1.54% compared to six months ago.

Quite similar situation also for the Day-Date that in the last few months has registered a really very rapid increase going to recover all the downside that there had been throughout 2023. At the moment this timepiece is still registering a slightly negative value compared to a year ago. We will see if the curve turns green again soon.

We will see if the future rise of cryptocurrencies and the favorable time of year will also lead to an uptrend in the market this time around, or instead the patterns will be belied.