Patek Philippe’s Secondary Market in the First Half of 2023

The first months of 2023 have brought a stabilizing phase for Patek Philippe and the entire secondary market. What will happen next?

Summer is a time for taking stock, leaving behind half the year and preparing to face the second half.

We at WatchAnalytics thought we would do the same: analyze what happened in the secondary market in the first part of 2023 to get an idea of what we might expect when we return from vacation.

For this first week of August we will provide you with macro analysis of Patek Philippe while next Friday we will talk about Rolex.

Through the data we collect daily we can find out more about how the brand as a whole is performing within the secondary market.

All the indexes you will see in this article are private but will soon be available on our website along with many others for different brands, models, and attributes.

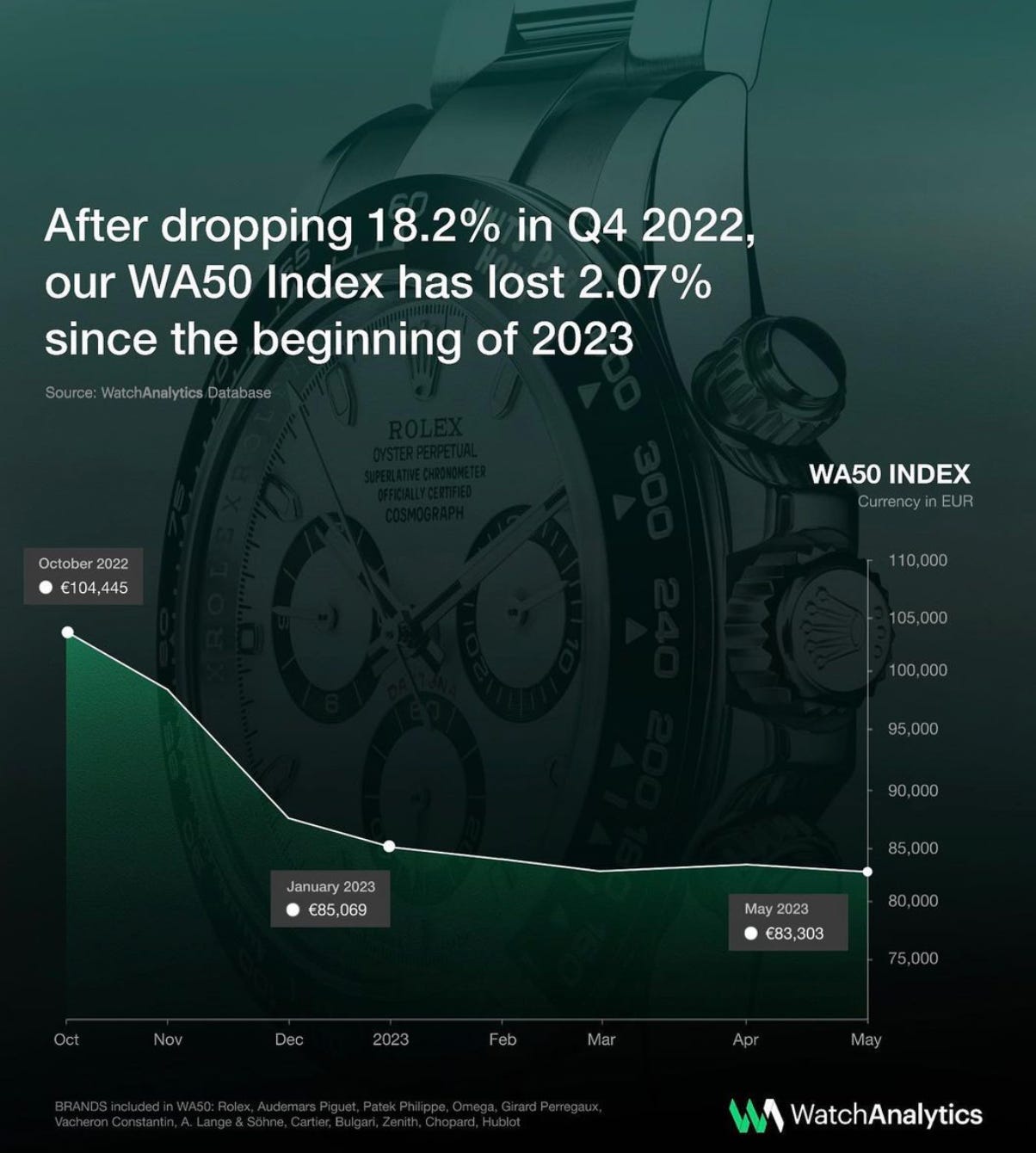

Before going into detail about Patek's performance, it is important to look at how the secondary market performed from the end of 2022 through June 2023, because inevitably the performance of the entire market affects the performance of individual brands.

During the first week of June, our systems processed the first data on the overall market performance in the first part of 2023.

The analysis comes from data recorded by the WA50, an index we created that includes the 50 most influential models in the market from 13 different brands.

After a decline of 18.2% in the fourth quarter of 2022, our WA50 index has lost 2.07% since the beginning of 2023.

Aggregate data for selected watches show that with the beginning of 2023, price declines have slowed sharply, giving way to a settling phase in which price changes are on average very close to zero. In March 2022, the index peaked at €130,103 to close the year with a loss of 34%, representing a negative delta in absolute value of more than €45,000. From the beginning of 2023 to the present, the absolute change is limited to €-1,766, testifying to the possible exit from the downward period that characterized last year.

These early months have outlined a completely opposite situation to that observed in 2022, the great price volatility has given way to a phase of stability.

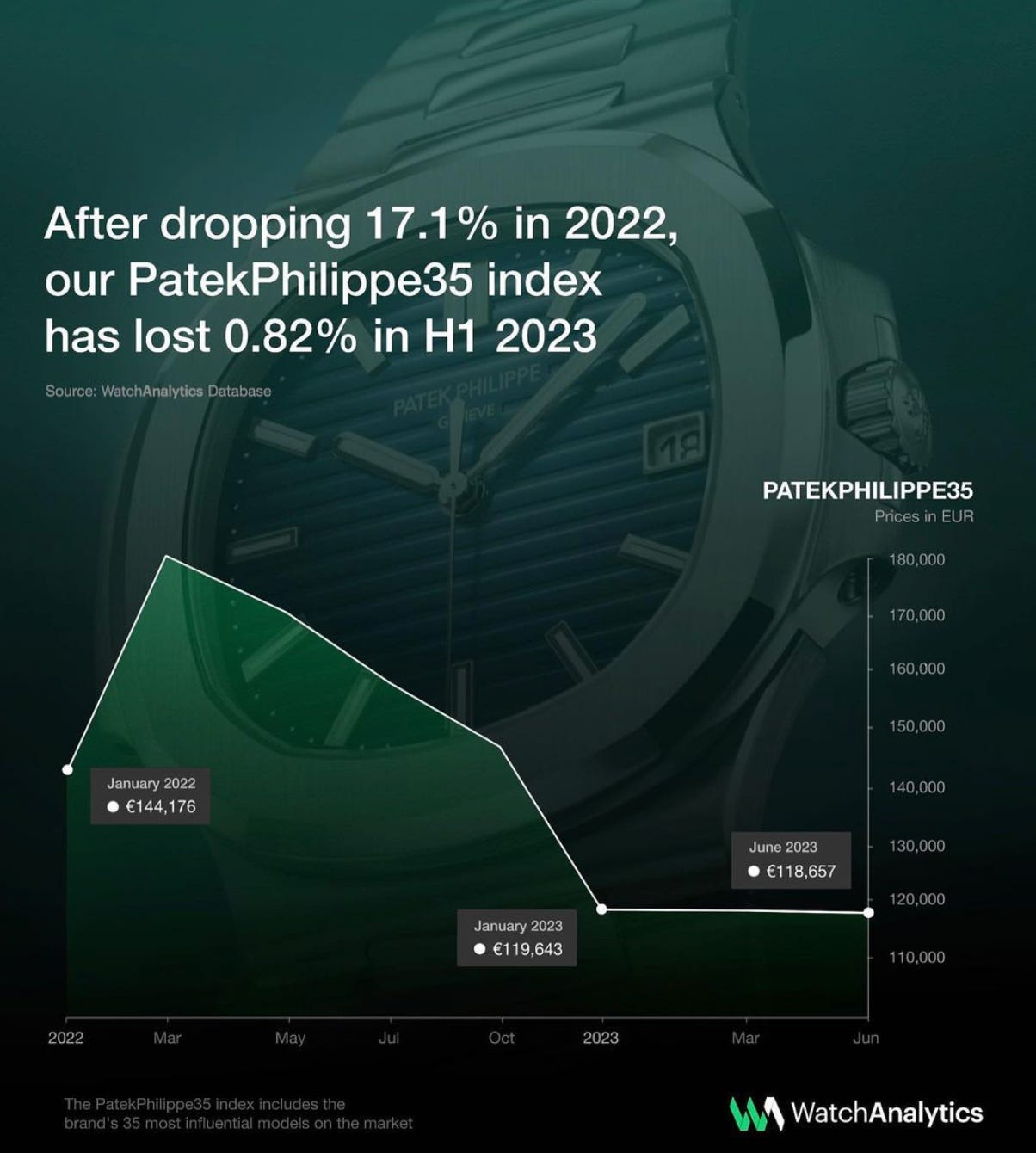

Taking into account this market context, it is now possible to analyze specifically how Patek Philippe has performed.

As can be seen from the graph, the situation of the brand's secondary market is no different from that of the entire secondary market.

After losing 17.1% in 2022, our PatekPhilippe35 index lost only 0.82% in the first half of 2023.

In early July, our systems processed the first data on the overall market performance in the first part of 2023 for Patek Philippe. The PatekPhilippe35 was constructed using the brand's 35 most influential models on the market.

In March 2022, the index peaked at €181,974 to close the year with a loss of 34.2%, representing a negative delta in absolute value of more than €62,000. From the beginning of 2023 to the present, the absolute change is limited to €-986, reflecting the possible exit from the downward period that characterized last year.

It is interesting to note that the percentage loss with which the WA50 closed 2022 is almost the same as that of the PatekPhilippe35. This figure highlights the very strong link that exists between the general market performance and the performance of Patek Philippe.

Analyzing the Patek data through another perspective in this chart we compare the average price of listings, all the listings that are posted, with the average price of sales, all the prices at which the watch is sold.

In this case the analysis is based on all Patek Philippe references within our site and raw values not yet processed by our pricing algorithm.

It can be seen between in June and August 2022 the price of the listings grew very strongly while the selling price had begun an initial phase of decline, the supply in that period was greatly exceeding the demand. This was the defining moment that then triggered the phase of sharp decline that lasted until the end of last year.

From June 2022 to the end of July, the green curve shows a 21.7% drop in the secondary market sales price, from an average of €119,018 to €93,127, remaining throughout the year from after June 2022 always below list prices in the range of 7% to 13%.

In recent months we can see a small growth in the average selling price and a much stronger increase for the average listing price, could this be a sign of a new change for the market?

Related posts: