Richemont’s Revenue Grows 10% in Q3, but Watch Sales Face Challenges

Strong overall performance masks the hurdles in Asia-Pacific’s luxury watch market

Last Thursday, Richemont Group's shares shot up +16% on the Zurich Stock Exchange, hitting a peak of CHF 161.8 (€172.45), marking an all-time high for this stock. The price in the following days remained stable above CHF 160.

The year 2025 opens with a bang, on the heels of an excellent 2024 for the Swiss group, which gained +21% on the stock market, rewarded by investors as it managed to withstand a difficult environment due to shrinking demand, especially in China. The interim report, presented early November, showed substantial stabilization of sales around €10.08 billion (-1% from €10.22 billion H1 2023).

The excellent performance of the past few days in the financial markets reflects the excellent 3Q corporate results presented to investors.

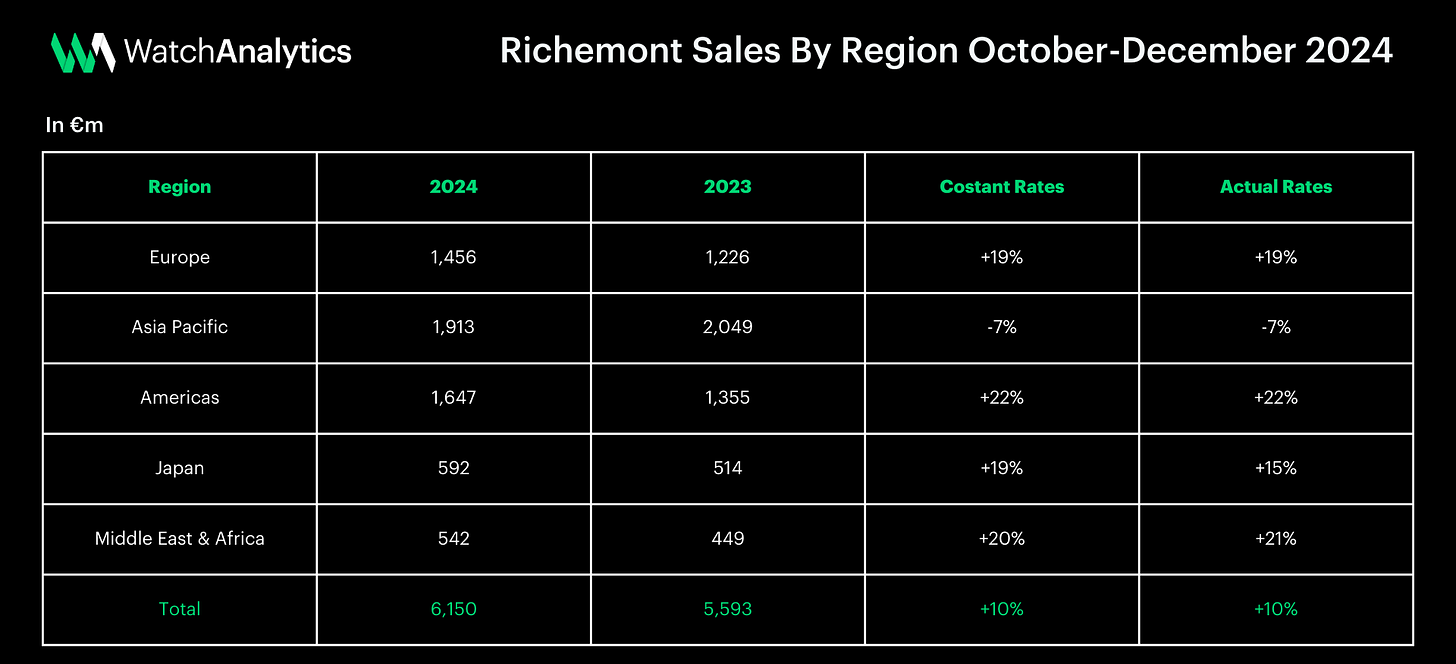

In fact, the group surprised everyone with a 10% increase in sales compared to 3Q 2023, totaling €6.150 billion while the 2023 result for the same period was €5.593 billion.

Q3 Richemont Sales By Region

As can be seen from the table, sales were excellent almost everywhere, aided by the Christmas season. America leads with +22%, followed by Middle East & Africa (+21%), Europe (+19%) and Japan (+15%).

China is a different story, as highlighted several times in previous articles, continues in its period of demand crisis impacting both watches and jewelry.

Q3 Richemont Sales By Business Area

Analyzing the results at the division level, or “ Business Area” as Richemont calls them, we observe that watches are -8%. After the -17% observed in Richemont's half-year result, the difficult situation for luxury timepieces shows no sign of abating.

The overall 9-month figure within Richemont's FY shows a -13% decline, with sales falling from €2.926 billion (9m 2023) to €2.524 billion (9m 2024).

Revenues at the region level reflected the above, with growth in all geographic areas except Asia-Pacific. Particularly significant double-digit increases were observed in the Americas and the Middle East and Africa region.

As far as the Swiss group is concerned, the performance of watches is more than offset by the excellent growth had by jewelry, which registered +14%.

In all likelihood, 2025, will follow in the wake of last year, with watch brands facing a demand in China that is struggling to recover. We will see if Richemont's April annual results or Swatch Group's infra annual results show different signals in the coming months.