Rolex Strengthens Leadership With CHF 10.5 Billion Revenue as Global Watch Sales Decline

Morgan Stanley's annual watch industry report shows a -2.5% decline in the Swiss watch market and a growing polarization between high-end and mid-range brands

In recent years, the Swiss watch industry has experienced a golden age, marked by rising sales and increasing revenues. These figures were also reflected in the value of Swiss watch exports worldwide, setting new records year after year. However, in 2024, data from the Federation of the Swiss Watch Industry (FHS) recorded a -3% decline compared to the previous year. After the strong post-pandemic rebound seen between 2021 and 2023, the business is now facing a slowdown that could signal the beginning of a recession.

The annual report from Morgan Stanley and LuxeConsult on the Swiss Watch Market confirms this trend. The overall market contracted, with the combined revenue of the top 50 brands decreasing from CHF 36.1 billion to CHF 35.2 billion.

This situation is exacerbating a strong polarization in the industry, particularly affecting mid-to-lower-tier brands struggling in this economic climate. According to the FHS, the number of exported watches has been steadily declining each year, indicating that fewer watches are being exported, but their average value is increasing. This is also evident in the Morgan Stanley report, which shows a drop in the number of units sold: from 16 million in 2024 to just over 13 million in 2023, a clear sign of a significant rise in the average selling price of watches.

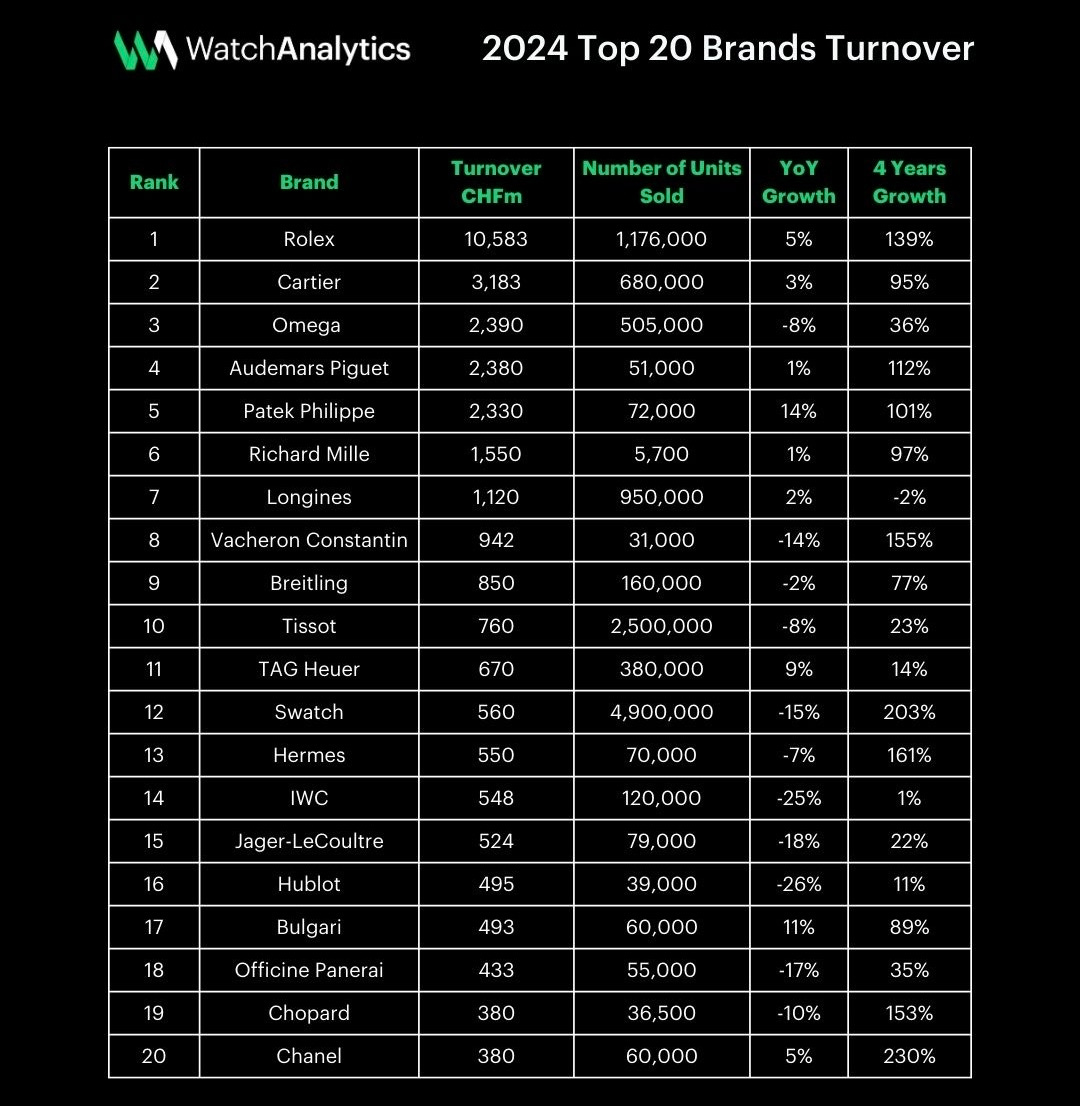

By analyzing data from the top 20 brands over the past four years, we observe a significant slowdown in revenue growth. Between 2024 and 2023, revenue declined by -1%, dropping from CHF 31.467 billion to CHF 31.121 billion. Growth has been decelerating year after year. Between 2021 and 2020, there was a +50% increase (from CHF 17.165 billion to CHF 25.780 billion), followed by +14% in 2022 and +7% in 2023.

Top 20 Brands Turnover

Rolex and Tudor

Once again this year, Rolex is the industry leader. The Geneva-based giant surpassed CHF 10.5 billion in revenue, marking a CHF 500 million increase from 2023. This further strengthens its market dominance, now holding nearly 32% of the total market share.

Since 2020 (when production halted due to COVID, resulting in a lower turnover), Rolex's growth has been remarkable, with a +139% increase in revenue.

In contrast, 2024 was a tough year for Tudor. Rolex’s sister brand suffered a sharp -34% drop in sales compared to the previous year, falling to CHF 360 million and slipping from 17th to 21st place in rankings. Tudor had already declined by -4% in 2023 from its peak of CHF 570 million in 2022.

Regarding the Rolex Group’s business strategy, a key event occurred recently: the decision to shut down Carl F. Bucherer, a brand acquired as part of the Bucherer retail chain acquisition. Despite significant sales over the years, the brand never achieved profitability. This decision highlights Rolex’s strategic vision, focused on strict financial management and strengthening its luxury market leadership.

Cartier e Omega

The rivalry between Richemont's flagship brand and Swatch Group’s leading brand continues. Cartier surpassed its Swiss competitor in 2021 and has maintained its lead ever since. Over four years, Cartier’s revenue has grown by +95%, while Omega’s increased by only +36%. In 2024, Cartier grew by +3%, whereas Omega declined by -8%.

Audemars Piguet, Patek Philippe and Richard Mille

As in previous years, Patek Philippe, Audemars Piguet, and Richard Mille solidified their positions in the top rankings.

Revenue growth for these three brands has been extraordinary, with Audemars Piguet up +112%, followed by Patek Philippe (+101%) and Richard Mille (+97%). In just four years, these three maisons have doubled their revenues.

TAG Heuer

An interesting data point comes from TAG Heuer, which recorded a solid +8% growth despite a downturn for most competitors. Although its growth since 2020 has been relatively low, LVMH’s strong focus on the brand is yielding promising results, potentially setting the stage for further expansion in the coming years.

Swatch

The time frame covered in this analysis highlights just how impactful the Moonswatch operation has been for the industry. Since 2020, no brand has grown as much as Swatch, which has tripled its revenue, rising from CHF 185 million to CHF 560 million.

Top 20 Brands Units Sold

The challenges facing the watch industry become even more apparent when looking at the decline in the number of watches sold compared to 2023.

Even Rolex, the market leader, sold 5% fewer units than in 2023. Lower down the rankings, the only brands showing positive growth in units sold are Cartier, Audemars Piguet, Patek Philippe, Richard Mille (as previously discussed), along with Bulgari and Chanel, which have focused heavily on innovation in recent years.

Retail Market Share by Group

Analyzing market share within the watch industry, four major groups dominate the sector:

Rolex Group (including Tudor) stands as the dominant player, with over 32% of the market.

Swatch Group, despite losing 200 basis points in 2024, remains a key player thanks to Omega, Longines, and Tissot.

Richemont, with brands like Piaget and IWC, saw a decline in sales, partially offset by Cartier's strong performance.

Patek Philippe increased its market share to 6.5%, surpassing LVMH’s entire watch division.

LVMH, despite the strength of TAG Heuer, holds a market share of less than 6%.

As seen from both revenue and market share data, major financial groups often struggle compared to independent brands. Patek Philippe, Audemars Piguet, Richard Mille, and Rolex continue to soar, maintaining high revenues and market shares. Meanwhile, luxury conglomerates frequently fail to give equal attention to all brands in their portfolios. A prime example is Longines, which has seen a -41% decline in unit sales since 2020.

Final Thoughts

The Morgan Stanley and LuxeConsult report paints a clear picture of the Swiss watch industry in 2024: a contracting market, dominated by a few major brands, with growing polarization between industry leaders and struggling brands. Rolex emerges as the undisputed winner, further cementing its leadership position, while legacy groups like Swatch and Richemont face significant challenges moving forward. With increasing market selectivity and uncertain global demand, 2025 is set to be a pivotal year for the entire sector.