Swiss Watch Exports to the u.s. +149% in April, -25% in May

Distributors frontloaded orders to avoid tariffs, but the rebound proved temporary

After a cautious start to the year, Swiss watch exports surged unexpectedly in April, only to slow down sharply the following month. This two-speed movement seems to reflect a tactical response to external factors rather than a structural shift in global demand.

The U.S. market, in particular, played a central role: it alone drove a record spike in export volumes in April, followed by a significant correction in May.

April Boom: +18% Globally, +149% to the United States

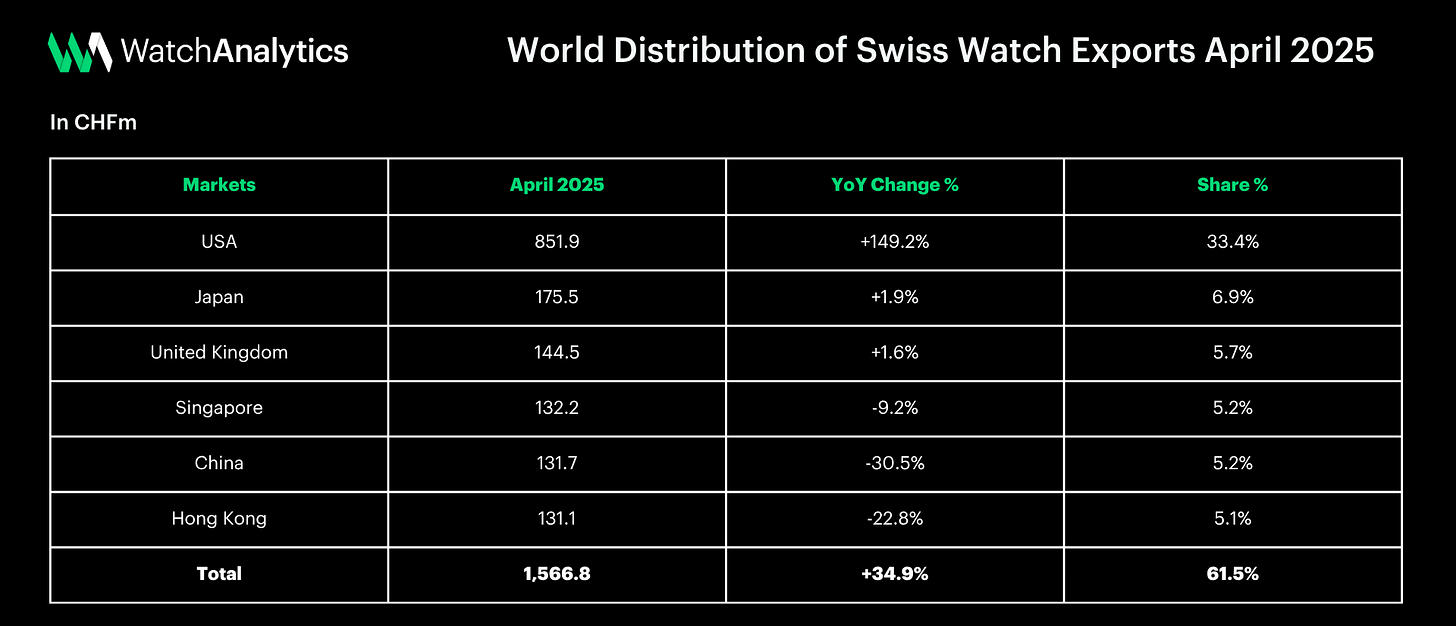

According to data released by the Federation of the Swiss Watch Industry (FH), global exports of Swiss watches rose by +18.2% in April year-over-year, reaching CHF 2.5 billion.

The main driver of this growth was the U.S. market, which saw an extraordinary increase of +149% compared to April 2024. A figure well outside the norm, which caught the attention of analysts—but one that appears to be the result of frontloading (i.e., bringing orders forward to avoid future costs) rather than an actual surge in end-consumer demand.

The announcement of possible import tariffs on Swiss watches in the United States—initially proposed at 31% and later reduced to 10%—prompted American distributors and retailers to fast-track orders in anticipation of price hikes. In response, watch brands ramped up shipments in a widespread attempt to secure inventory before the new tariff regime came into effect.

May: -9.5% Correction, Led by a Sharp Drop in U.S. Orders

As often happens in such cases, April’s rush was followed by a period of normalization. In May, total Swiss watch exports fell by -9.5% year-over-year, settling at around CHF 2.1 billion.

The most significant slowdown came from the United States, where exports dropped by -25.3% compared to May 2024. A figure that confirms the previous month’s growth was both exceptional and temporary.

The American rebound also masked a more complex underlying picture. Already in April, many Asian and European markets were showing signs of weakness. In May, Hong Kong, mainland China, Japan, and the United Kingdom all posted negative results, with declines ranging from -10% to -17%.

Nevertheless, the cumulative data from January to May remains positive, with an overall increase of +1.1% compared to the same period in 2024. However, excluding the anomalous April spike, year-to-date growth would be close to flat.

Several external factors continue to complicate the outlook. The strengthening of the Swiss franc is weighing on exports, while ongoing uncertainty around trade policy between the U.S. and Europe is affecting pricing and distribution strategies across major brands.

The industry now seems torn between protecting margins and sustaining demand, in a context where consumer behavior is increasingly sensitive to fiscal changes and price fluctuations.

Final Thoughts

The U.S. market remains a cornerstone for Swiss watchmaking, yet it is highly susceptible to external dynamics. April’s spike helped brands close the first four months of the year with unexpectedly solid performance. However, the drop in May shifts focus back to a fragile environment, where tactical decisions can shape figures more than long-term trends.

The second half of the year will be crucial in determining whether the industry can convert frontloaded demand into steady sales—or whether volatility will continue to dominate.

Geopolitical tensions could also emerge as a new variable in shaping the months ahead.