The Battle of Retailers and Resellers

Changes in the Luxury Watch Industry: The Acquisition of Bucherer by Rolex, the Fall of Watched of Switzerland Shares, and the challenges of resellers

Two weeks ago Rolex purchased Bucherer, in a deal as unexpected as it was important.

There was a lot of confusion after the announcement: with the shares of the main competitor, Watches Of Switzerland, plummeting.

If we then combine this with the news of Hodinkee's staff cutbacks, due to falling secondary market prices, we can see how much turmoil there is among retailers and resellers.

But let's go in order.

On August 24, 2023, Rolex announced the acquisition of Bucherer.

The deal for an undisclosed sum marks the Geneva-based maison's first major foray into retail

The official motivation behind this deal concerns the issue of management succession. Jörg Bucherer, 86-year-old grandson of namesake founder Carl Bucherer, has no heirs, and given the uncertainty of leadership, Rolex said it wanted to safeguard the operational stability of one of its most important retail partners.

However, it appears difficult to imagine that this deal was made solely with these ends in mind.

Bucherer operates more than 100 boutiques worldwide and has had a close relationship with Rolex for about 100 years, so it is no coincidence that the Certified Pre-Owned Program was initially activated only at the Swiss retailer.

This is the element to consider.

Rolex is one of the very few luxury watch brands that has chosen not to open its own boutiques but rely solely on third-party sales. Most other brands, on the other hand, have adopted the opposite strategy by increasingly investing in opening their own boutiques in a direct-to-consumer mode.

The breakthrough of launching the CPO marked a change on the part of Rolex, which also began to look more closely at sales, in this case that of second-hand models.

It should therefore come as no surprise that with this new acquisition the crowned maison is planning to revolutionize its first-hand watch distribution model as well, perhaps with a more centralized policy.

For the time being, however, the loser in this situation is Watches Of Switzerland, which saw its shares drop 23.5% the day after the deal.

This prompted WoS directors to buy a considerable number of shares on the market. Earlier this week, the four board members notified the London Stock Exchange that they had purchased shares with a total value of £890,000 at a price per share of about £5.90.

This was done to give a signal of confidence to the market that Bucherer's acquisition will have little or no effect on its relationship with Rolex.

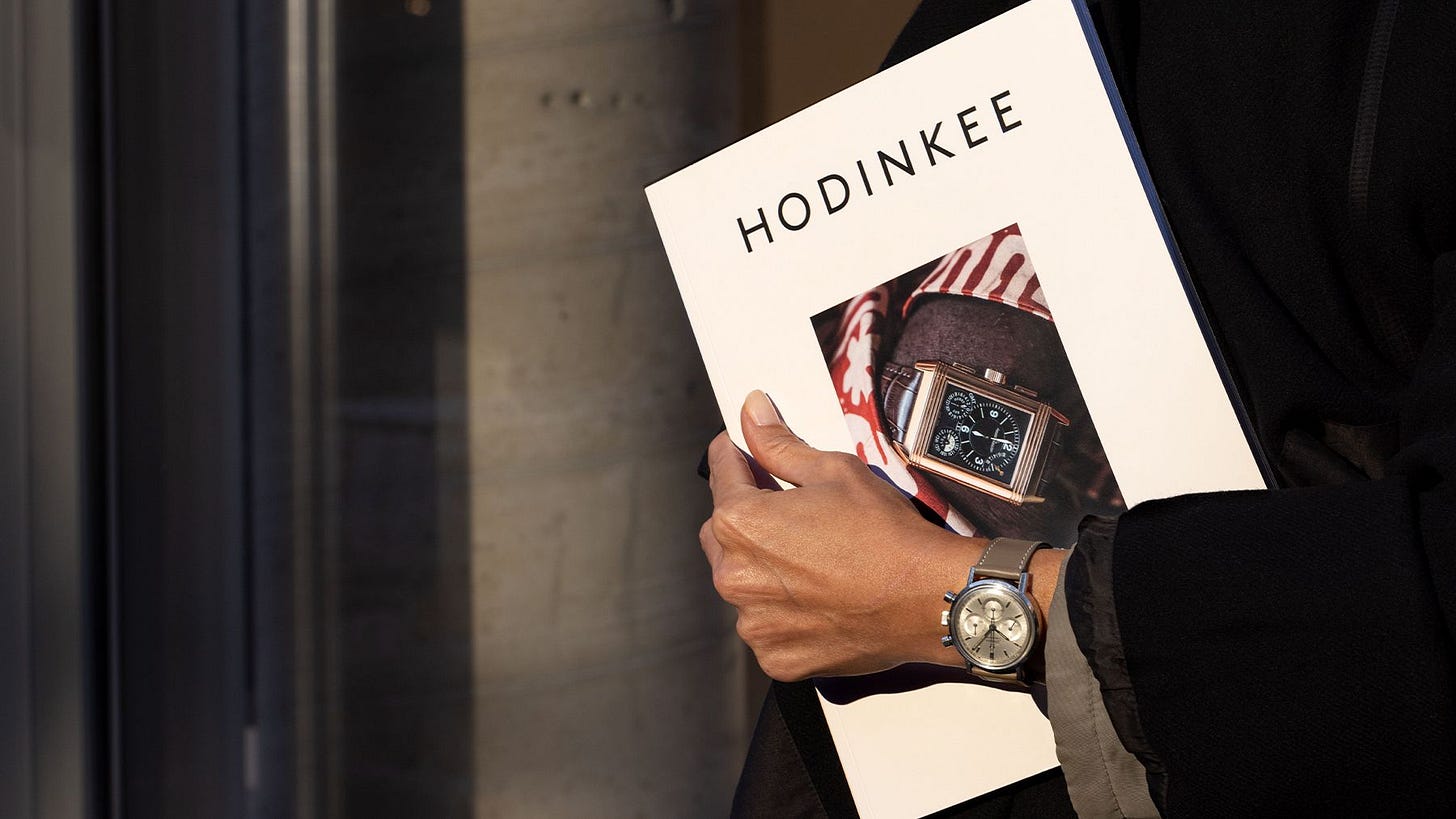

Even the big resellers seem to be having some problems, starting with Hodinkee.

The watch retailer and news site backed by Bernard Arnault's LVMH Luxury Ventures is cutting nearly 20% of its staff due to the collapse in used watch prices.

Weighing on the U.S. company's balance sheet is its purchase of Crown & Calibre in 2021, at the peak of the secondary market.

However, the last six months of 2022 saw a steep drop in prices, and this sent the company, which was previously in the black, into a loss-making situation.

In January, Chrono24 also had to cut about 13% of its staff due to the decline in the secondary market.

From the complex situation of all these companies, both retailers and resellers, we understand how much this whole industry is changing. Brand sales distribution decisions and fluctuations in the secondary market have led to major evolutions.

It will be interesting to see how the industry will emerge from this period of great challenges.

Related posts: