Watch Industry Report 2025 – Part 1: Financials and Exports

A Closer Look at Early 2025 Performance and Market Dynamics

An Italian version of this article is also available on the Orologi “Le Misure del Tempo” website, at this link link.

The first six months of 2025 have confirmed that the Swiss watch industry is undergoing a phase of transition. The signals are mixed: on the one hand, the industry has shown adaptability in an unstable global context; on the other, external shocks—such as tariffs, currency fluctuations, and the Chinese slowdown—have put pressure on exports and financial performance, forcing major groups to reassess their strategies and pricing.

The turning point came between March and April, when the United States announced new tariffs on imports of European luxury goods, including Swiss watches. The Swiss franc, already strong at the beginning of the year, further appreciated against the dollar, squeezing margins for manufacturers. At the same time, the price of gold reached new highs, increasing production costs for the most prestigious models. This combination of factors created a climate of uncertainty that impacted the logistical and commercial decisions of all players in the sector.

Exports: Acceleration and Deceleration

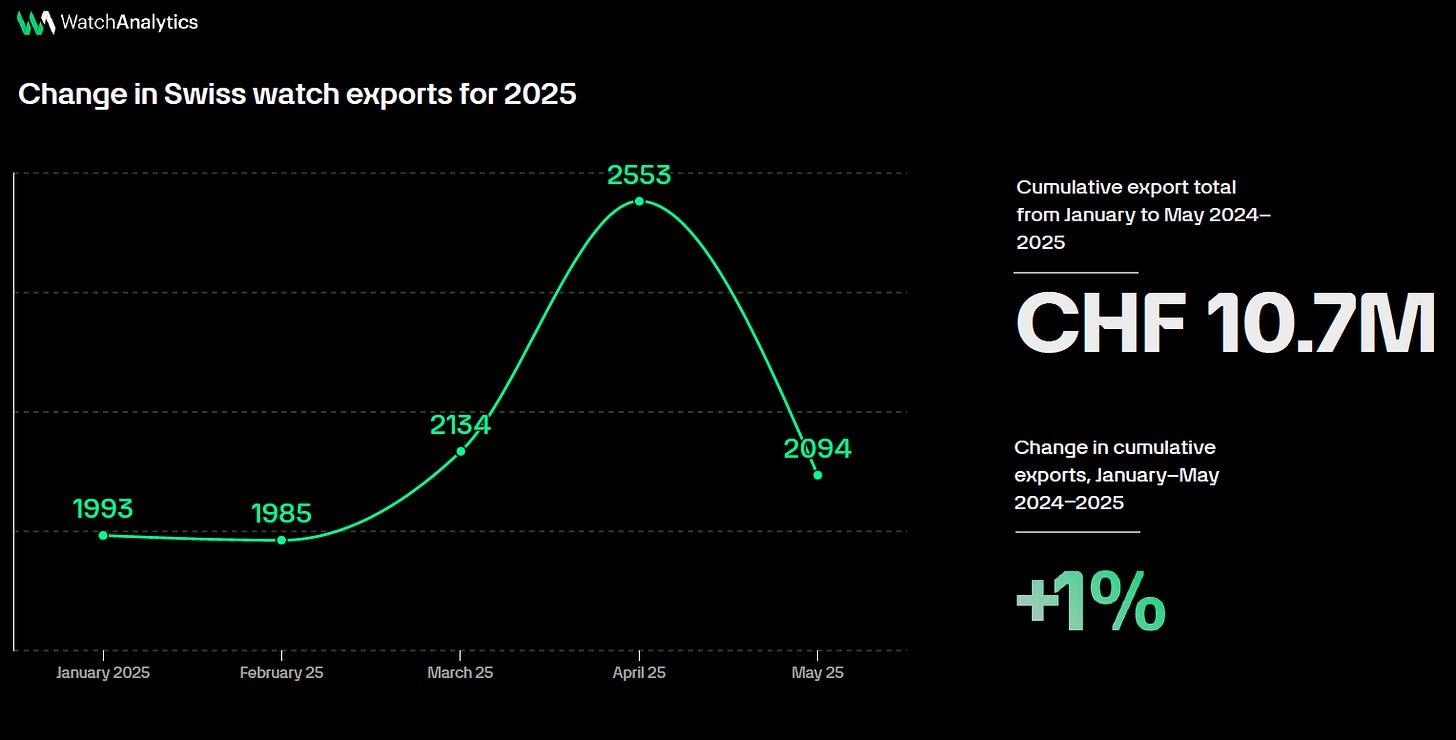

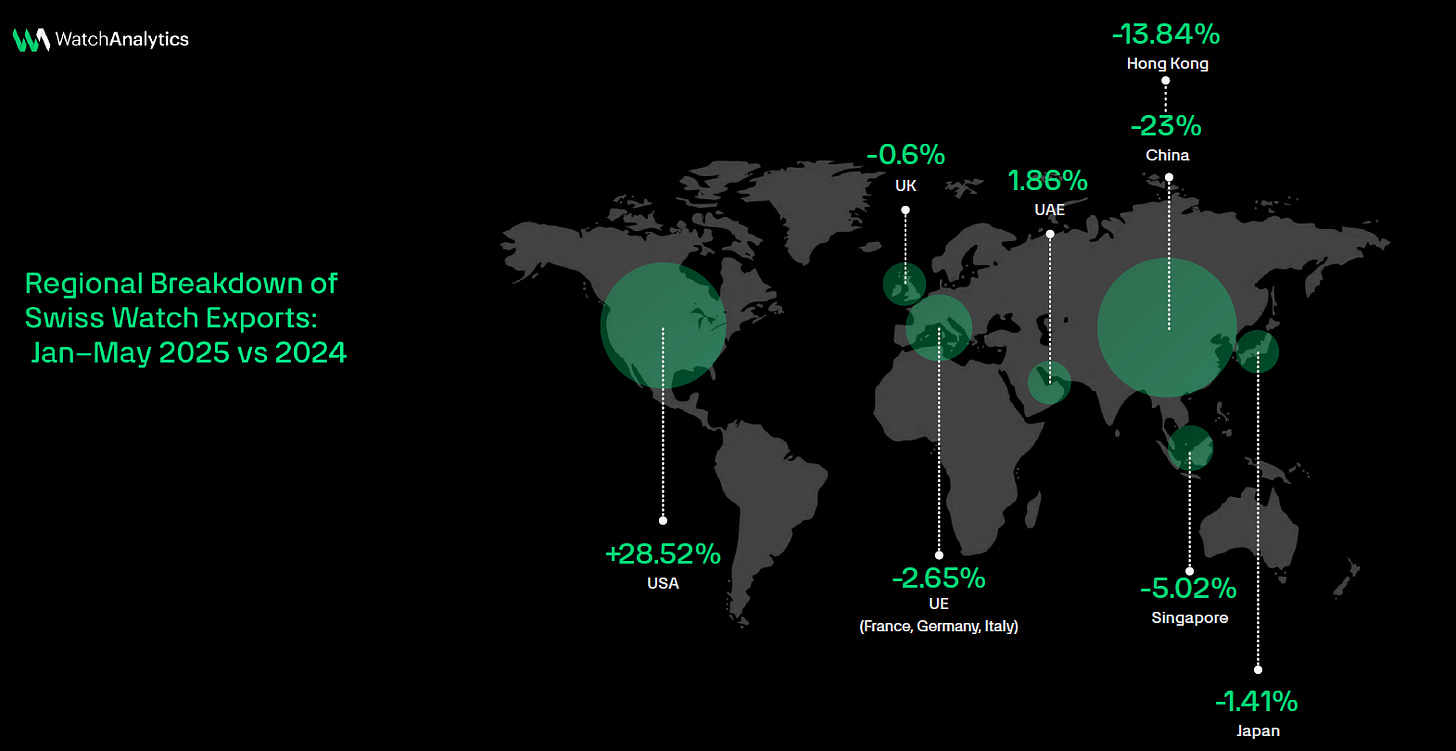

In the first quarter, Swiss exports maintained a cautious yet positive trend (+1.5% year-on-year in March). However, April recorded the most significant spike: +18.2% compared to the same month in 2024, with shipments to the United States rising by 149%. This exceptional figure is not a sign of booming demand, but rather the result of a tactical move, so-called front-loading, in anticipation of the tariffs coming into effect.

The reaction was immediate: in May, overall exports fell by 9.5% year-on-year, with a 25.3% drop specifically in the U.S. market. This decline weighed down the five-month performance: total growth slowed to a modest +1%, and the total number of watches exported fell to the lowest levels since 2020.

Financial Performance of Major Luxury Groups

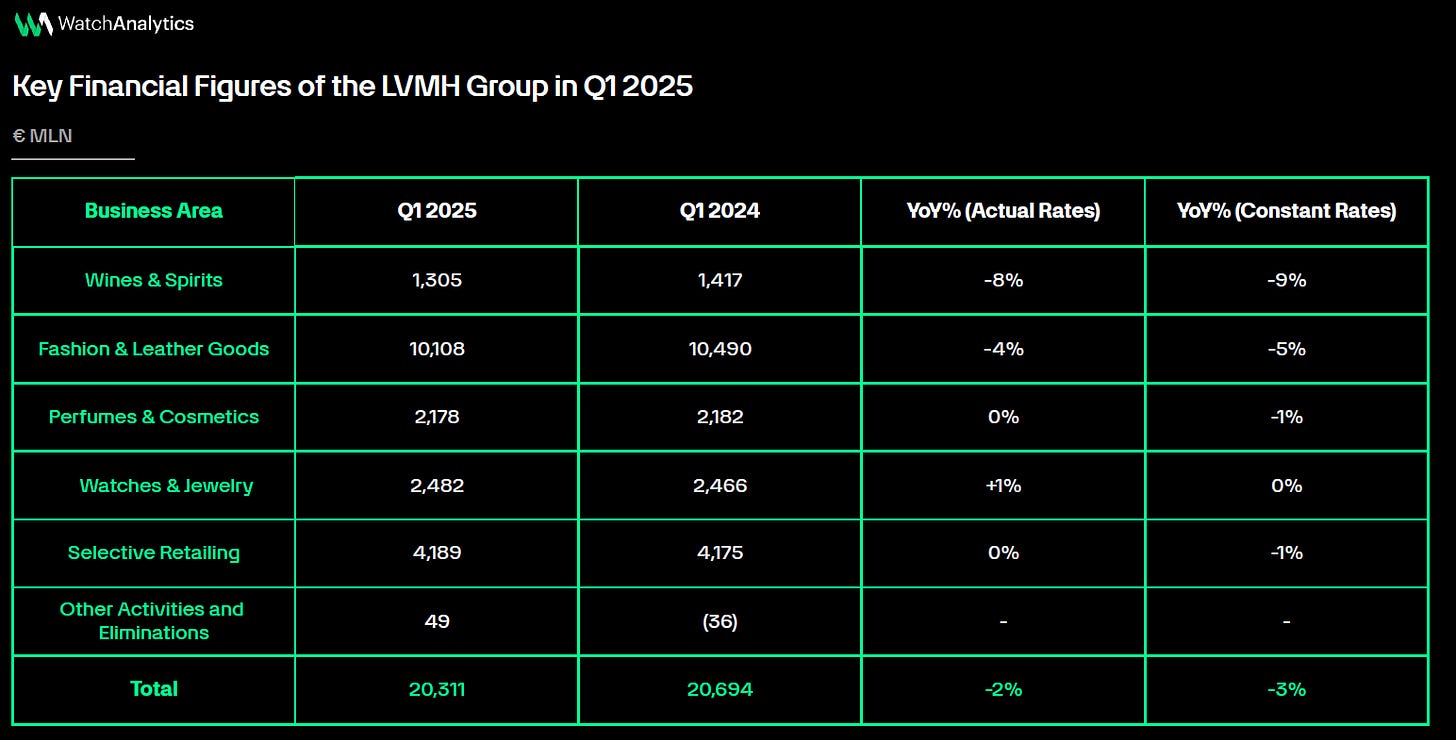

The financial results of the major luxury groups clearly reflect these dynamics, though with varying intensity.

LVMH, in its Q1 report published on April 14, posted an overall revenue decline of 2–3% compared to 2024, but showed resilience in its Watches and Jewelry division, which grew by 1%, driven by TAG Heuer, Bulgari, and Tiffany. Conversely, the Fashion and Leather Goods segment fell by 4%, due to weak demand in the United States and Asia. This suggests that the watch segment, while not immune, has shown stronger defensive capabilities.

Richemont, which closed its fiscal year in March and published results in early May, reported stable sales at constant exchange rates and a slight 1% decline at current exchange rates. Europe and the Middle East supported the results, while China underperformed. High-end brands such as Vacheron Constantin and A. Lange & Söhne held up well, while brands like IWC and Panerai were affected by a slowdown in wholesale channels. Direct-to-consumer sales, however, continued to perform positively.

Finally, Rolex, despite not publishing official financial data, announced a 3% price increase in the U.S. at the beginning of May. The price adjustment focused on gold models, aiming to absorb rising costs and anticipate the impact of tariffs. This emblematic move shows that even the most robust brand cannot ignore external pressures.

Final Thoughts

The first half of 2025 has tested the Swiss watch industry. The artificial spike in exports in April did not conceal the structural difficulties of a fragmented and evolving global market. But the real challenge lies in the second half of the year, when it will become clear whether the countermeasures are sufficient to preserve profitability and volumes, or if the sector will need to fundamentally rethink its growth strategies.