Watch Industry Report 2025 – Part 2: Secondary Market

A Closer Look at Early 2025 Performance and Market Dynamics

An Italian version of this article is also available on the Orologi “Le Misure del Tempo” website, at this link link.

Having analyzed the performance of major brands in the first half of 2025, it is now time to turn our gaze to the secondary market, which is increasingly indicative of the real perceived value of luxury watches.

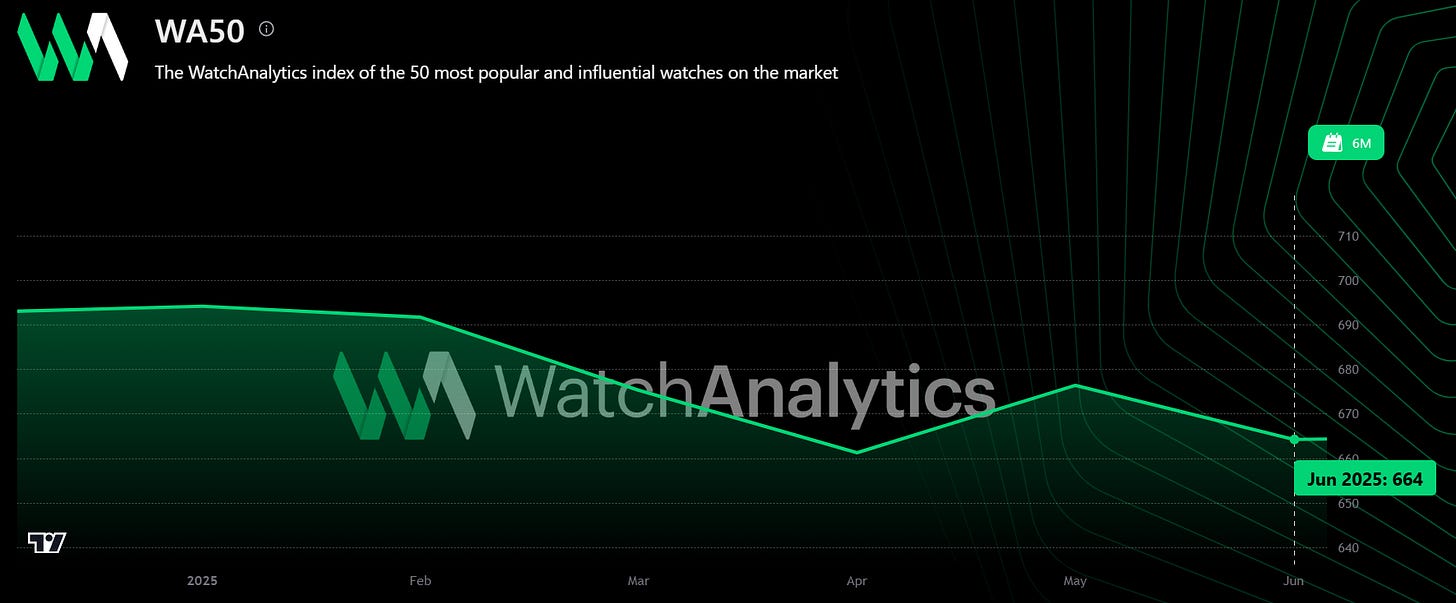

WA50

The WA50 index, which monitors the performance of the 50 most traded models, shows a generally stable market. Despite the absence of major surges, there is a slight recovery in the spring, caused by Watches & Wonders, followed by a settling in early summer.

In June 2025 the index touched 664, registering a live decline of -4.3% from January 2025 when it was 694.

The decline is across the board across all brands, starting with the sovereigns of the market, namely: Rolex, Patek, and Audemars.

Rolex

The Rolex35 index shows solid resilience, with stable average prices and steady interest in the most popular models. There were no surprises, but the brand continues to confirm itself as a certainty in the secondary market.

After a more timid start to the year, from April the index began to rise to 750 in June, realizing a +3.7% compared to the beginning of the year.

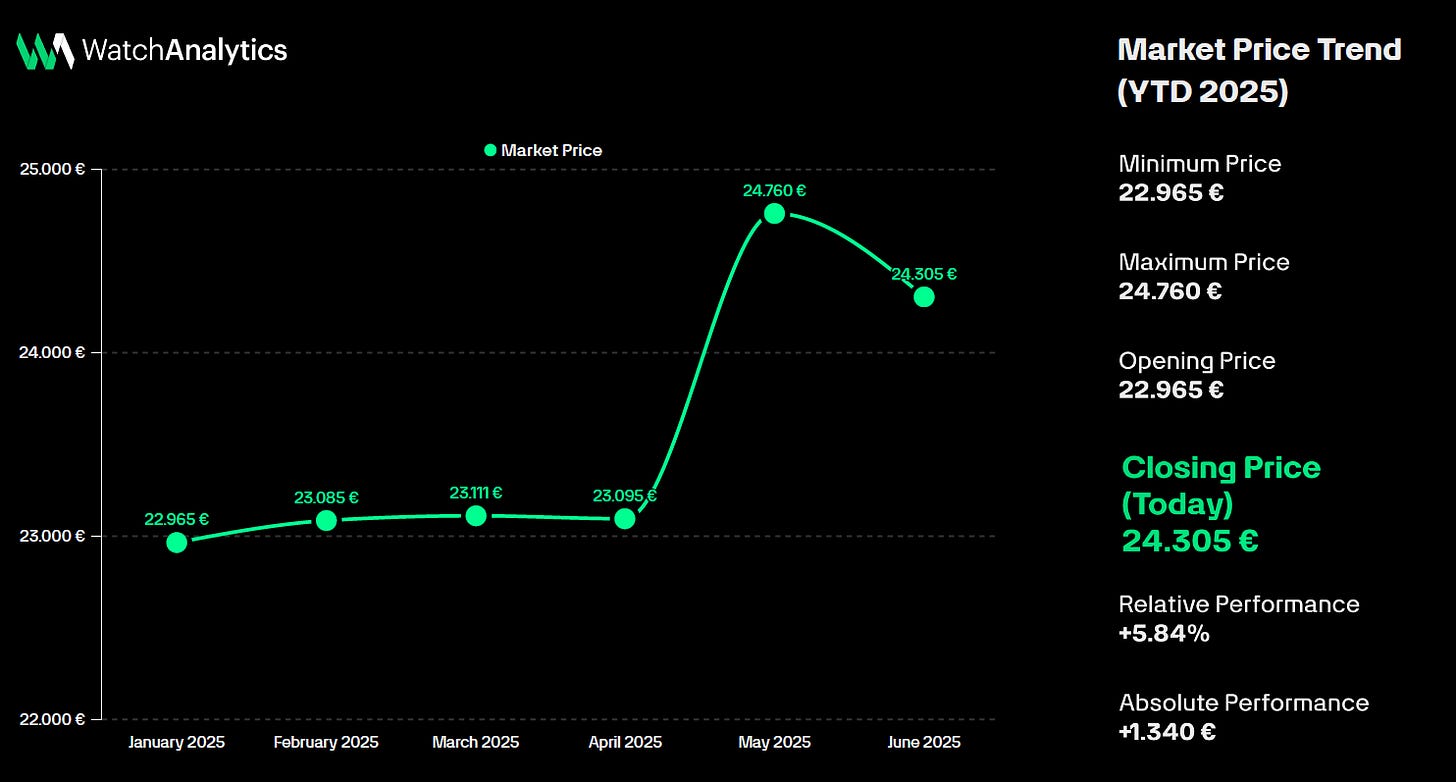

In order to analyze this brand more specifically, we chose to look at the performance of the Daytona 116500LN-0002, one of the maison's most iconic models, as well as a protagonist in the secondary market in recent years.

The performance of this model in the first months of the year mirrors what happened in WA50, with the price gaining €1.665 between May-April. In the last month the performance dropped slightly, but the trend is still positive with +5.84% in the first 6 months of 2025.

The Daytona 116500LN-0002 is also one of the most popular references in the market. This slide represents the status of active listings as of June 2025, an impressive 449. The lowest bid is just above €20k, and the range with the most bids is around €23k-€24k.

The price also varies depending on the condition of the watch and the presence of equipment; in this slide we have summarized how the value changes based on these characteristics as of June 2025.

Audemars Piguet

In contrast, the AUDEMARSPIGUET35 index reveals a different dynamic, with a final value of 649 points as of June 2025. The curve shows a more volatile trend, characterized by an initial peak followed by a more pronounced downward trend than Rolex.

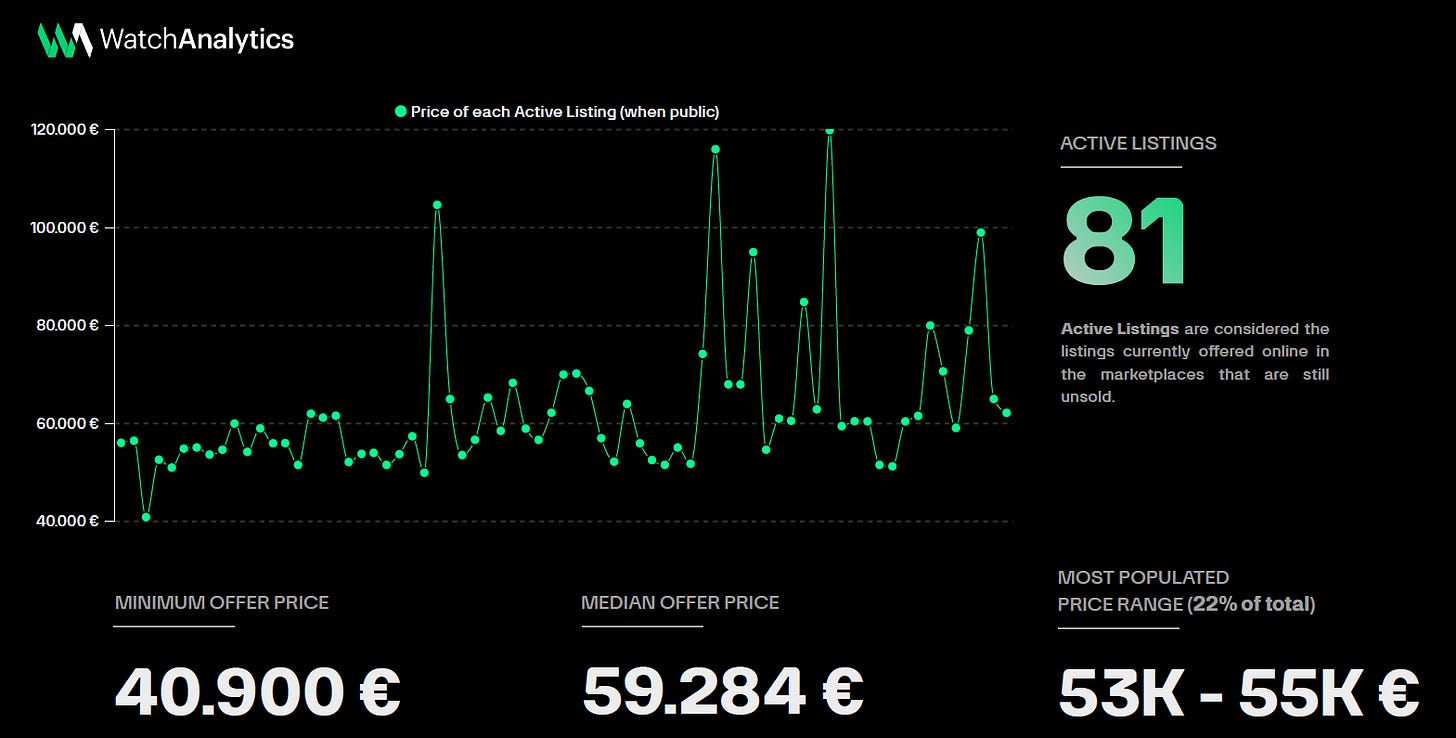

In this case the model analyzed is the iconic Royal Oak, the 15202 ST.

Price trends during 2025 reveal a clearly positive and steady trend. The market value showed gradual but sustained growth, rising from €57,571 in January to reach €58,261 in May. From that peak the price then fell in June, marking a slightly negative performance of just under -2%.

The market for active listings has very diverse characteristics that tell a complex story. In June, the median bid price stands at €59,284, while the most populated range, between €53,000 and €55,000, accounts for 22% of total listings. The overall price range is remarkably wide, ranging from as low as €40,900 to over €120,000. This variety probably reflects the different conditions of the watches, the accessories included, and the possible model variants on the market.

A particularly interesting aspect emerges from the analysis of the impact that conditions and accessories have on the final value. The data clearly show how these factors significantly influence the quotations. A new example with all original accessories reaches €56k, while the presence of the original box alone reduces the value to €51k. The situation becomes even more evident when observing how a watch without accessories in like-new condition can drop as low as €48k.

Patek Philippe

The PATEKPHILIPPE35 index shows good stability. The graph shows a relatively stable situation with the value standing at 671 points as of June 2025. The curve shows slight fluctuations during the period analyzed and is basically superimposed on that of Audemars. The most sought-after models continue to maintain high prices, supported by strong demand among collectors and investors.

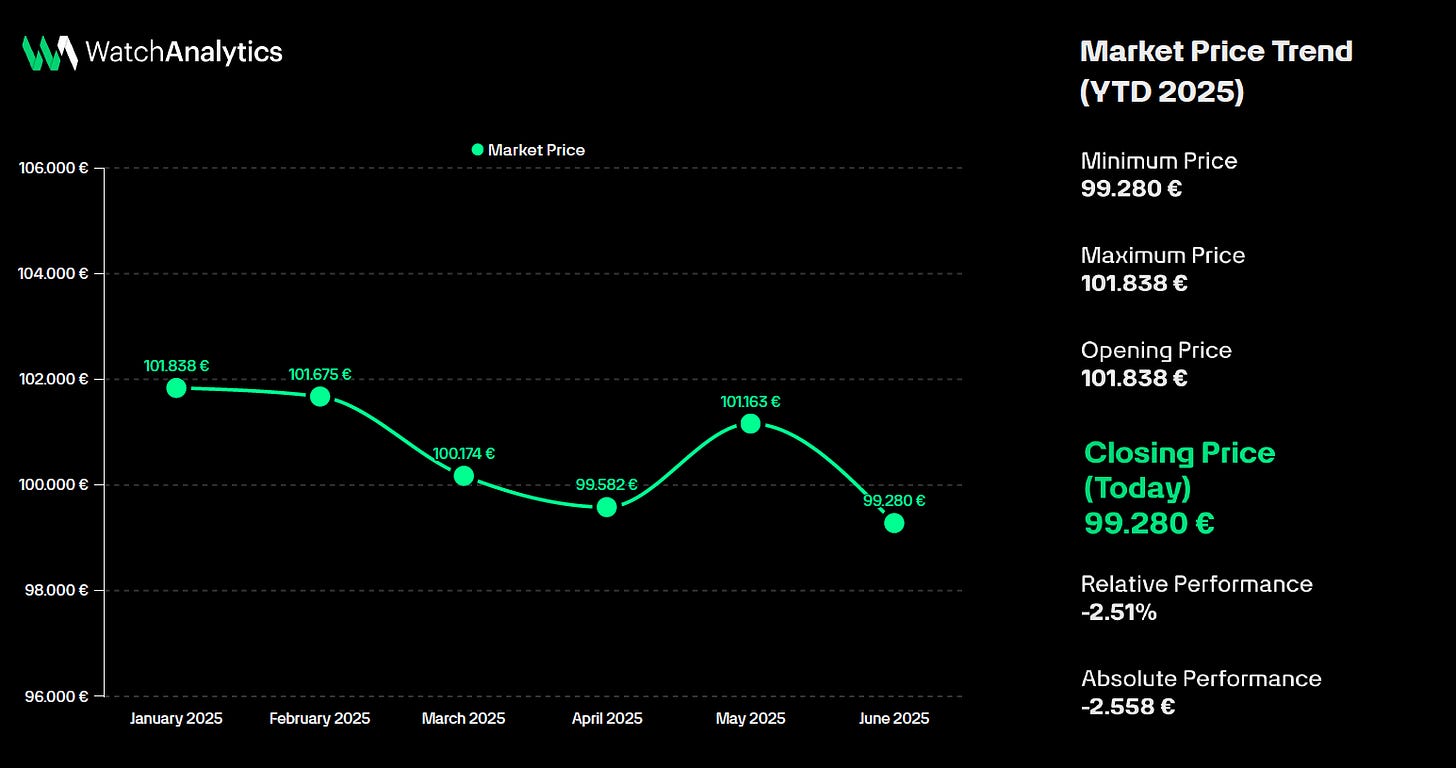

We could not close without talking about the Nautilus, the 5711/1A.

Price trends during 2025 show particularly robust and steady growth. The market value started from €101,838 in January to reach €99,280 in June, registering a decline of about -2.5% in six months. What is most striking is the regularity of this decrease, which showed particularly noticeable accelerations between March and April, suggesting times of sharp declines on the part of the market.

The active listing market reveals characteristics that confirm the premium positioning of this watch. The median bid price stands at €102,696, significantly higher than the Royal Oak, while the most populated range is concentrated between €100,000 and €105,000, still accounting for 22% of the total.

The impact of condition and accessories is even more pronounced in this high price range. A new example with all accessories can reach €99,280, while the difference between a complete watch and one without accessories can exceed €21k.

Final Thoughts

The first half of 2025 confirms the maturity of the secondary market for luxury watches. After years of sustained growth, the sector now shows more moderate and differentiated trends between brands. The overall stability of the WA50 index, with limited fluctuations, reflects a market that has achieved a balance between supply and demand.