Group Results Mid-2025: Swatch Down -7%, Richemont Watches Slide, but Jewelry Shines

U.S. Sales Surge 10–30% for Swatch Brands, Cartier Lifts Richemont Amid Asia Slowdown

Following our in-depth look at early 2025 trends and export dynamics, we now turn our attention to the half‑year results of two major players: Swatch Group and Richemont. These new disclosures shed light on how each group is navigating lingering market turbulence, currency pressures, and shifting regional consumption patterns.

Watch Industry Report 2025 – Part 1: Financials and Exports

Stay ahead of the curve – subscribe to our weekly blog to keep up with the latest news, info and insights from the watch market

Swatch Group: Strength in the U.S., Weakness in China

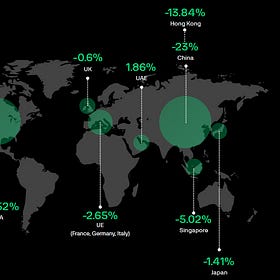

Swatch Group’s H1 2025 results delivered a stark contrast: net sales fell by -7.1% year‑on‑year to CHF 3.06 billion, while operating margin shrank from 5.9% to 2.2%, dragging net profit down from CHF 147 million to CHF 17 million. The downturn reflects a clear drop in Chinese demand, including Hong Kong and Macau, offset only partially by solid growth elsewhere.

China’s share of global sales has slid from 33% to 24% over the past 18 months, a significant reversal from pre‑pandemic levels when Chinese demand accounted for roughly half of group revenues.

Meanwhile, North America showed robust performance: Omega, Longines, Rado, Tissot, Hamilton, and Swatch all posted sales gains between 10% and 30%, supported also by growth in India, Turkey, the Middle East, and Australia.

Richemont: Jewelry Soars, Watches Lag

Richemont posted 6% constant‑currency sales growth (to €5.4 billion) for Q1 FY 2025, yet sector details reveal contrasting trends.

The Specialist Watchmakers division, which includes Panerai, IWC, Jaeger‑LeCoultre, and Vacheron Constantin, saw sales fall by -7% year‑on‑year, with declines centered in China, Hong Kong, Macau, and Japan. The yen’s strength against the euro and dollar further weighed on results in Japan.

By contrast, the Jewellery Division, with key brands Cartier, Van Cleef & Arpels, Buccellati, and Vhernier, grew by 11%, helped by Cartier’s strong performance (comprising approx. 47% of Richemont’s watch-related revenue when included).

Geographically, the Americas and Middle East & Africa posted 17% YoY growth, Europe 11%, Asia Pacific remained flat, and Japan declined by 15%.

All distribution channels, retail, wholesale, and online, recorded balanced 6% growth, signaling sustained demand albeit with shifted regional dynamics.