In the Last Three Years, Revenues of the Top 7 Watch Brands Have Increased by CHF 4.4 Billion

The Morgan Stanley Annual Report on The Watch Industry shows that from 2021 Rolex has increased its revenues by 25%, Audemars by 49%, and Patek by 34%

This week saw the release of Morgan Stanley and LuxeConsult's report on the watch industry. As I told you a few weeks ago, talking about the new export record achieved, this research also highlights how this industry is experiencing a very prosperous period.

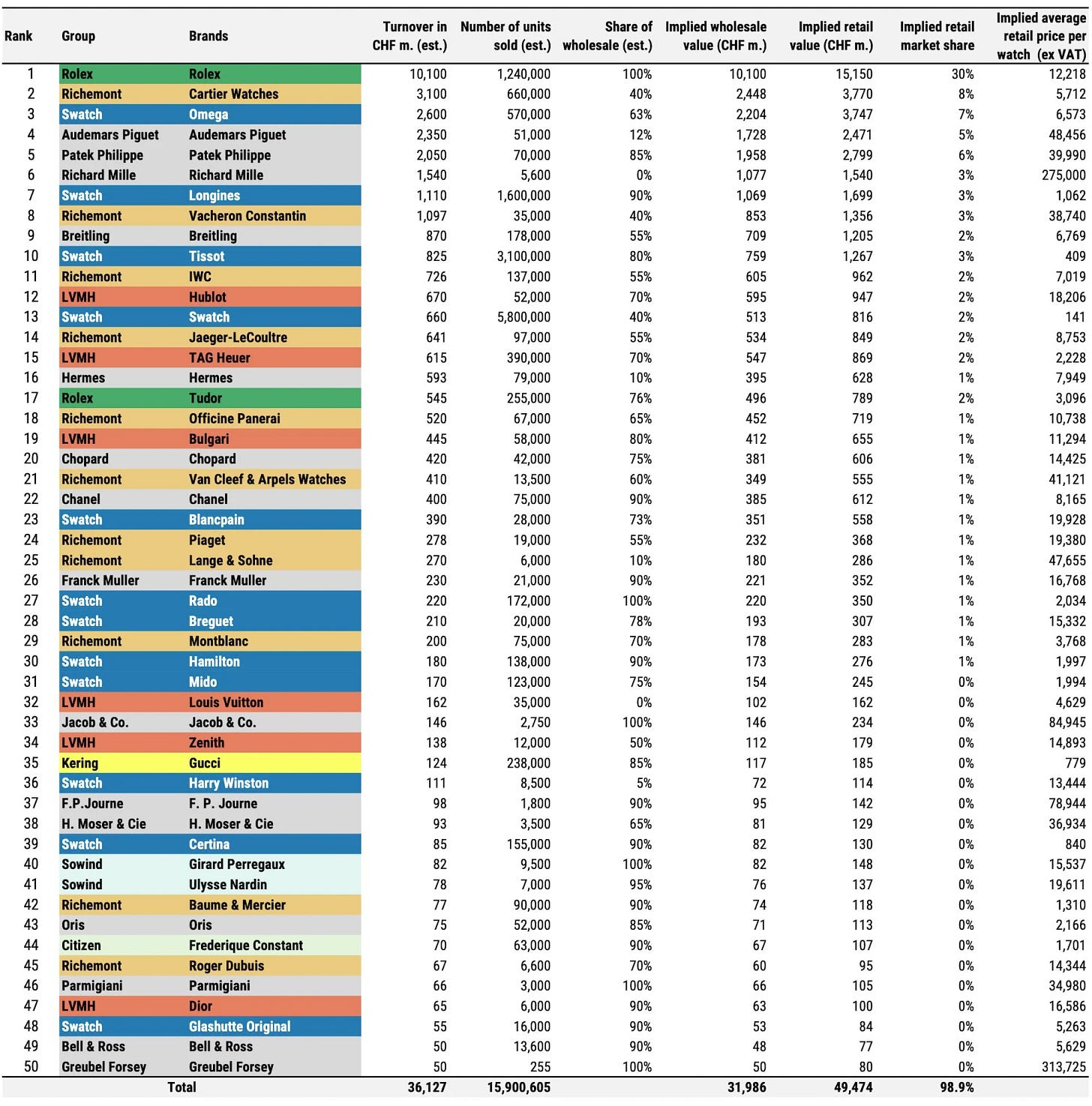

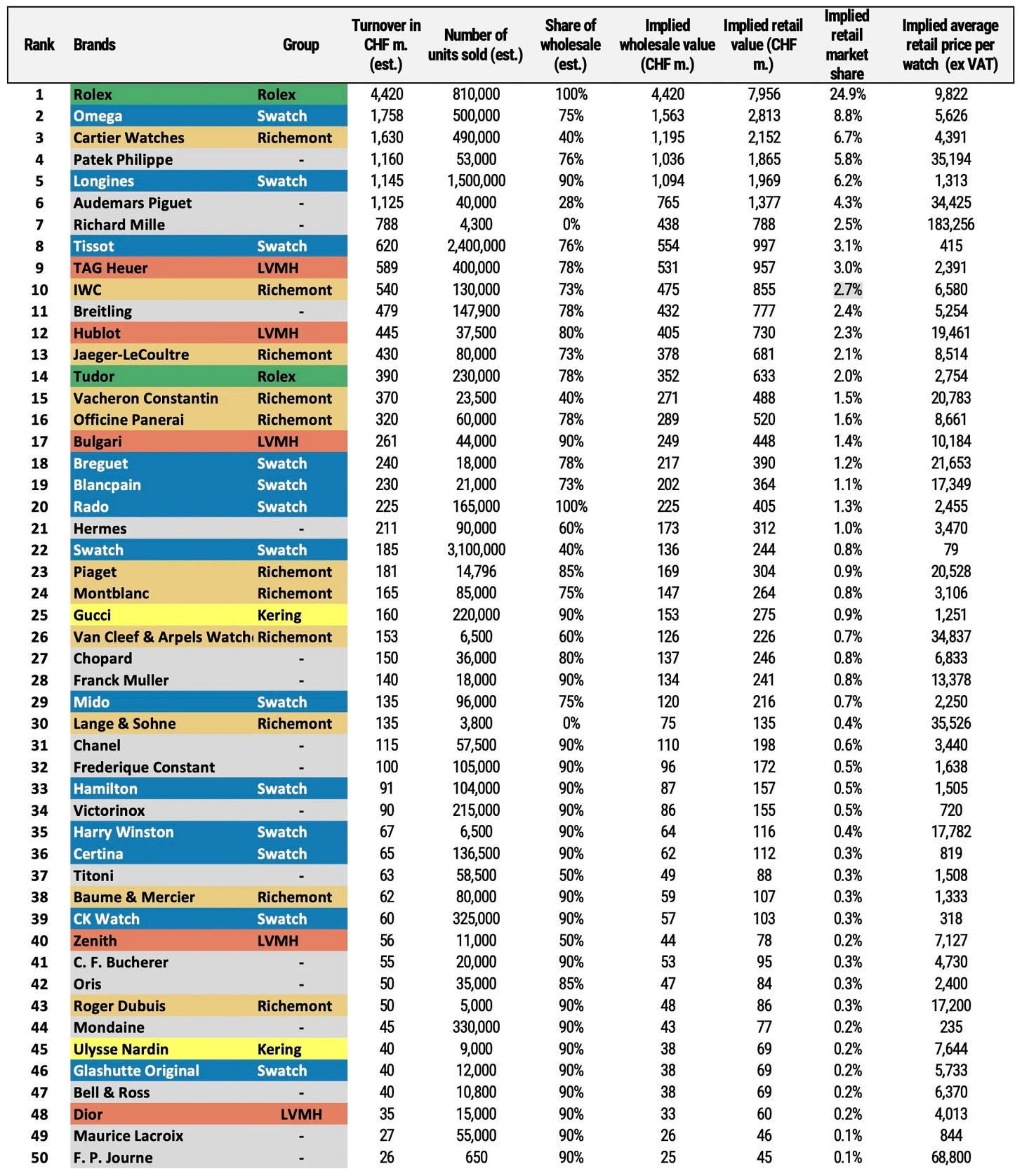

The Federation of the Swiss Watch Industry has estimated a 7.6 percent growth over 2022 for watch exports from Switzerland to the rest of the world, and this new report estimates the past year to have reached 50 billion francs considering all retail sales and a turnover of 36 billion Swiss francs.

Record-breaking Rolex and new entries among billionaire brands

The brand with the most revenue overall is obviously Rolex, benefiting from an extremely good year by reaching over 10 billion in sales. Rolex's growth has continued year after year, in 2020 it reached 4.4 billion, producing about 810,000 pieces, a result also influenced by Covid, in 2021 it almost doubled its revenue by touching 8 billion with 1,050,000 pieces produced, in 2022 it grew by +15.5% with 9.3 billion in revenue and 1,200,000 pieces produced, and in 2023 it reached the historic result of more than 10 billion in revenue.

Then, between second and third place we find a challenge that has been going on for four years now with Cartier and Omega as protagonists. In 2020 the Swatch Group brand was in front, with revenues of 1.7 billion while Cartier generated about 100 million less. The overtaking was then accomplished in 2021 and maintained in both 2022 and 2023, with Cartier recording revenues of 2.4 billion (2021), 2.7 billion (2022) and 3.1 (2023). Omega, on the other hand, achieved revenues of 1.7 billion (2020), 2.2 (2021), 2.5 (2022), and 2.6 (2023).

Audemars remains as firmly in 4th place as it has for the past three years; in fact, the real leap was made between 2020 and 2021, when the Le Brassus-based maison went from sixth position with revenues of 1.1 billion to fourth place by increasing its revenue by 400 million in a single year. Compared to last year, the brand made an additional 200 million in revenue, rising from 2 billion to 2.35. Patek Philippe surpasses 2 billion in revenue for the first time, growing steadily over the past four years, 1.2 (2020), 1.5 (2021), 1.8 (2022) and 2 in 2023.

Richard Mille, on the other hand, is the brand that has experienced an incredible exploit in recent years, before 2019 it did not even appear in the top 20 list of maisons, in 2019 it enters it by ranking eighth, in 2020 it climbs one position by generating revenues of 788 million. In 2021 it surpasses 1 billion, in 2022 it rises to 6th place with 1.3, and in 2023 it reaches 1.5.

Rounding out the list of billionaire brands is Longines, with a performance quite similar to that of 2020, and Vacheron Constantin, which reaches 1 billion for the first time in its history. The latter has achieved a truly remarkable climb in recent years, rising from 14th position in 2019 and 2020 to 8th only two years later.

To understand how much this industry has grown in recent years it is useful to compare the total revenues of the top 7 brands in the 2021 ranking with the 2023 ranking. I chose not to use 2020 because the data are too affected by the pandemic and would not have returned a clear understanding of the market. The list of top 7 brands is the same as it was 3 years ago, the only difference is that Longines has dropped from 4th place to 7th. In 2021 the total revenues of these maisons were 18.42 billion while in 2023 they grew by 4.4 billion to 22.85, marking a growth of +24%.

Rolex Dominates, Swatch Group down slightly, Richemont down

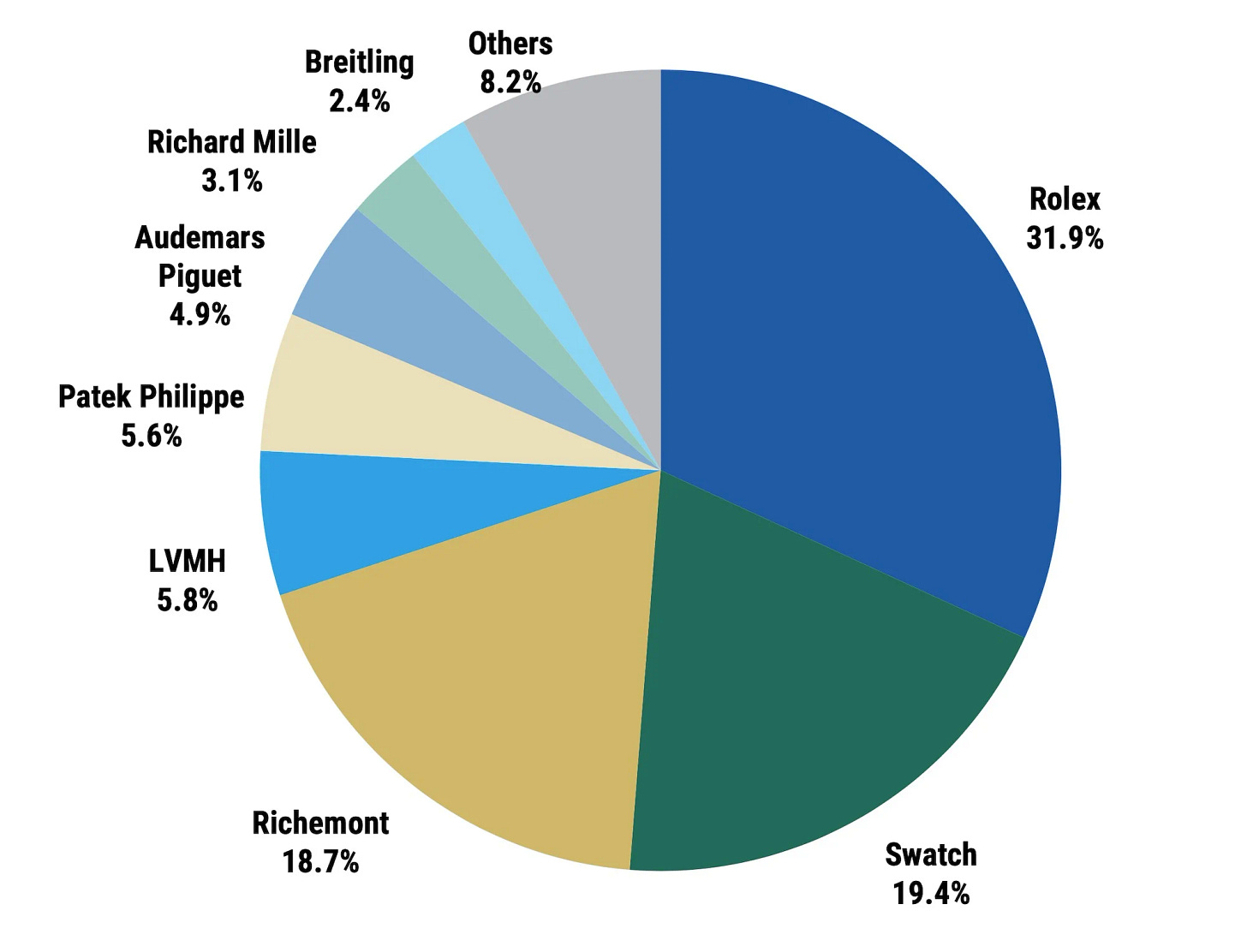

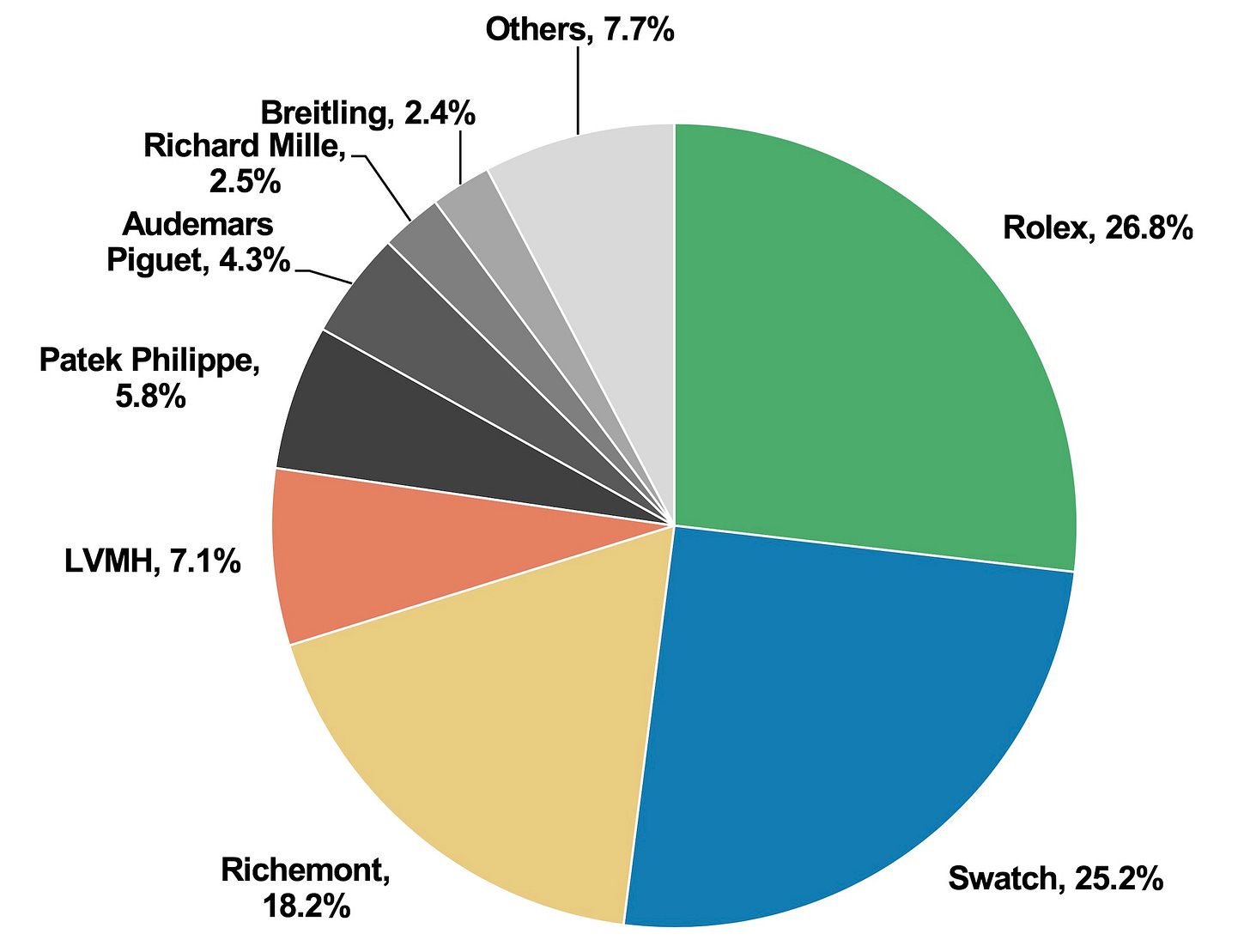

Analyzing the results achieved at the market share level, an absolute domination by Rolex is observed, as expected, achieving a market share at the group level of 31.9%, while at the individual brand level it is 30.3%.

The market share of the Rolex brand grew from 28.8% in 2021, 29.2% in 2022 to 30.3% in 2023. At the group level, on the other hand, market share is recorded a small decline this year. In 2020 it was 26.8%, in 2021 30.5%, in 2022 30.9%, and in 2023 it dropped to 30.3%, marking a -0.6%. This is a very slight decrease, and the reasons would mainly concern a small drop in Tudor, which fell from 15th place in terms of sales, to 17th, overtaken by Tag Heuer and Hermes.

However, the group's performance remains mind-blowing especially when we consider the fact that it consists of only two brands. Although Rolex accounts for more than 90% of the group's sales, Tudor has been making a remarkable impact in recent years and is one of the best-performing brands in the entire Swiss industry with a +31% increase in sales in 2022 over the previous year. Tudor's performance is the result of a careful strategy on the part of the group. In fact, if we look at the past few years, the strategy was very clear. On the one hand, Rolex was concentrating on developing watches with modern lines, producing ever larger case sizes, using new materials such as ceramic, platinum, and titanium, and offering ever bolder colorations. On the other hand, Tudor was given the task of keeping the heritage of the maisons alive with watches that had a very clear reference to vintage, and in this sense the Black Bay 58, 54 and Pro are the perfect example. The great fascination that precisely these more vintage designs hold for enthusiasts coupled with the increasing difficulty in finding Rolex models has prompted more and more people to direct their purchases toward this brand that in the past had always been considered secondary.

Next in second place is Swatch Group with 19.4%, a share slightly down from previous years; in 2020 it was 25.2%, in 2021 due to the Covid effect it dropped to 19.8%, and in 2022 it was 22.2%. Last year's great performance had been driven mainly by the success of MoonSwatches, which skyrocketed the Swatch brand's accounts and despite this year's decline, is continuing to generate great success for the group. As specified by the report, this success accounted for 73% of the brand's sales, totaling 660 million Swiss francs, a 63% increase over the previous year, marking the largest gain among all the brands in the top 50. Another positive factor concerns the excellent performance by Tissot, thanks to the success of the PRX line.

In third place is the Richemont Group with a market share of 18.7%, which declined compared to previous year. In 2020 it was 18.2%, in 2021 it rose to 19.1%, 19.5% in 2022, and now it’s down by -0.8%. A. Lange & Söhne has performed well, this is also in line with what is happening in the secondary market with some models going up in price, indicating strong interest in this brand. I talked about it below a few months ago.

Vacheron also performed well, which, as mentioned above, exceeded 1 billion francs in sales. While IWC recorded a -13% drop in sales and the same goes for Panerai. In contrast, Cartier experienced significant growth, gaining a 0.5% market share compared to previous years, thus equaling Omega at 7.5%.

In analyzing the data reported in these rankings, basically two factors emerge, both of which are very positive for any watch enthusiast. The first is that, beyond market fluctuations whereby some brands decline and others are on the rise, basically the watch industry is a very healthy one with many brands making record sales figures year after year. The second relates to the fact that the competition has become really fierce, depending on the various price ranges the competition between maisons from different groups is very fierce. Increased revenues and increased competition are the two best elements for the development of any industry with companies being forced to create new and better products to continue to survive. Precisely for it is reasonable to expect more and more new things from the watch industry: new watches, new materials, and new complications. The conditions for this to be a period to remember for this industry are all there, it is up to the brands to surprise us.

Related Post