Swatch Group Revenue Falls 12%, LVMH Watch Sales Drop 2%, and Swiss Watch Exports Decline 2.8% in 2024

Luxury watch industry struggles as Chinese demand weakens, impacting Swatch, LVMH, and overall Swiss watch exports in 2024

Last week Swatch Group and LVMH presented their financial results for 2024, highlighting a complex year for the luxury watch industry. After Richemont's solid results, which posted 11% growth in total revenues thanks to its jewelry houses, the focus shifted to the industry's other two giants.

Swatch Group

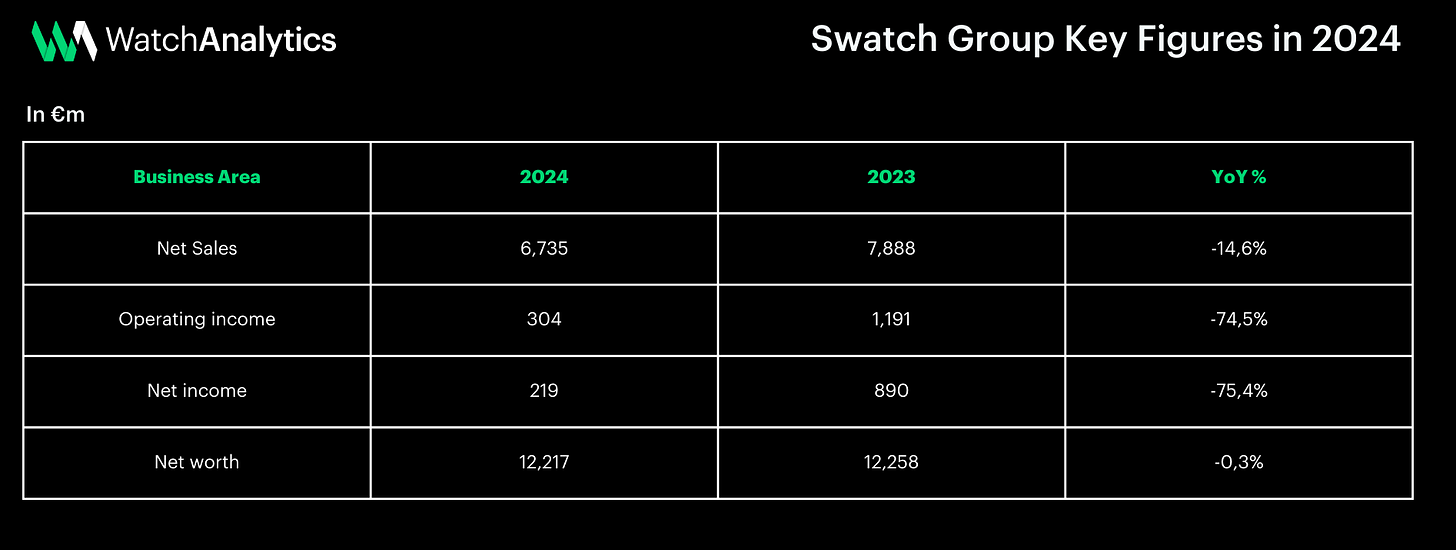

Swatch Group ended 2024 with sales of CHF 6.7 billion, down -12.2% at constant exchange rates (-14.6% at current rates). The decline in sales was accompanied by a collapse in operating profits (the net income derived from a company's primary or core business operations) of -75%, down from CHF 1.2 billion to CHF 304 million. The operating margin fell to 10.6% from 17.2% in the previous year. This was partly due to Swatch Group's strategic decision to maintain marketing investments, particularly related to the Paris Olympic Games.

The key factor that negatively affected the group's performance was the decline in demand in China, a crucial market for luxury watchmaking. Wholesale sales also declined more than 10%, signaling retailers' caution about the medium-term outlook. China, Hong Kong and Macau continued to show a sharp slowdown, with sales in these regions declining by about 30%. The share of total sales in these markets fell to 27% from 33% in the previous year, reflecting a persistent weakness in demand from Chinese consumers and a reduction in the flow of Chinese tourists to Southeast Asia.In the U.S., Omega, Longines and Swatch performed well, with Tissot surpassing $100 million in sales for the first time. Japan, the third-largest export market for Swiss watches, recorded high double-digit growth, with Harry Winston, Omega, Longines and Tissot strengthening their positions.

However, the group experienced significant growth in markets such as the United States, Japan, India, and the Middle East, with Omega, Longines, and Tissot among the best-performing brands. Breguet and Blancpain particularly suffered from the difficult market environment, while Harry Winston and Omega performed well. Mid-range brands such as Rado, Longines, and Tissot also performed well. The continued popularity of the MoonSwatch and Scuba Fifty Fathoms Swatch, supported by the launch of new models such as Mission to the Super Blue Moonphase and Mission to Earthphase, further contributed to sales.

LVMH

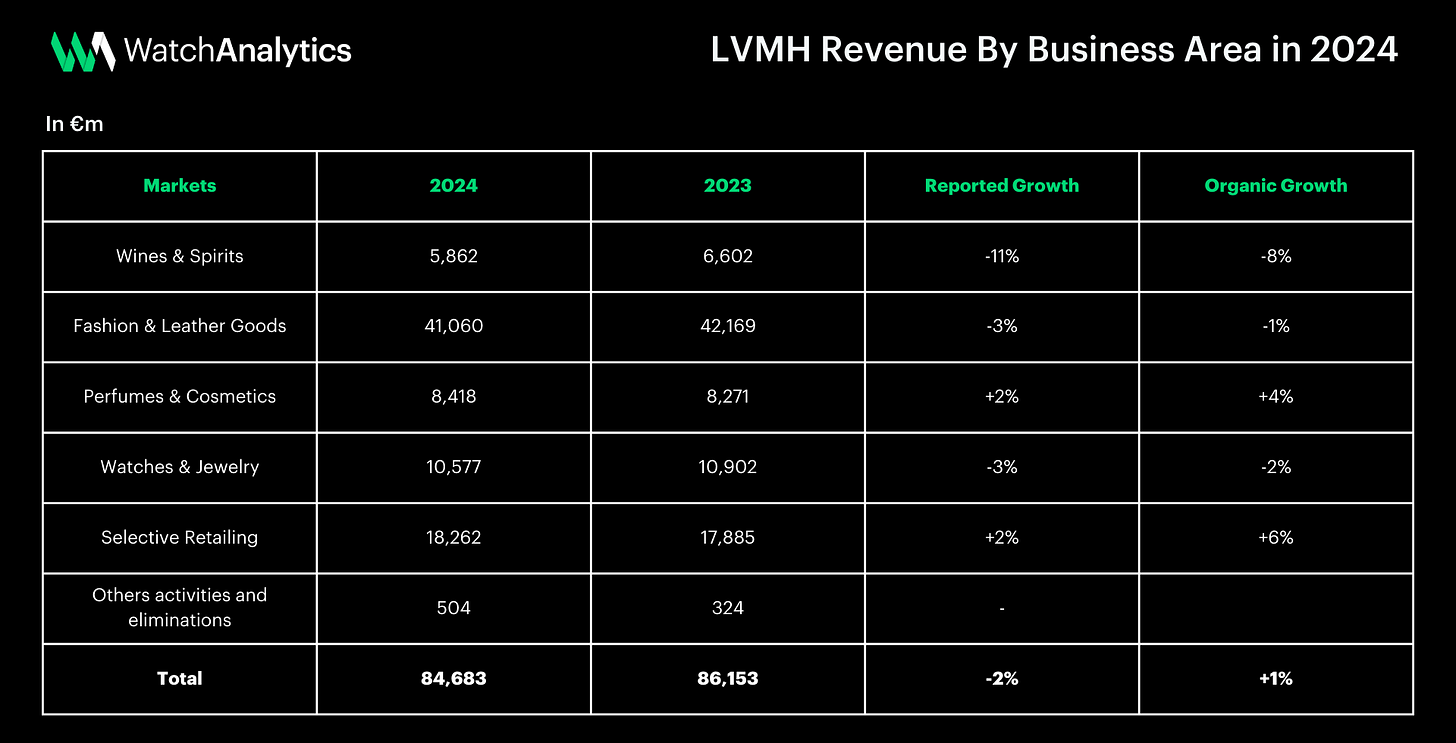

LVMH ended 2024 with revenues of €84.7 billion, registering 1% growth over 2023. However, profit from recurring operations fell -14% to €19.6 billion, reflecting a weaker demand environment and investment in stores and communication.

The Watches & Jewelry segment, which includes brands such as TAG Heuer, Hublot, Zenith, and Bulgari, posted a 2% (-3% organic growth) decline in revenues to €10.5 billion. However, the fourth quarter showed signs of improvement (+3%), indicating a possible turnaround in 2025.

Geographically, LVMH benefited from double-digit growth in Japan (+28%) and more moderate increases in the United States (+3%) and Europe (+2%). In contrast, sales in Asia fell 11%, hurt by economic uncertainty in China.

So much will change in the coming year, and a key element going forward will be the recent reorganization of the watch division with the creation of LVMH Watches, led by Frédéric Arnault. LVMH has also signed a 10-year agreement with Formula 1, in which TAG Heuer will play a leading role in timekeeping. These strategic investments could strengthen the group's position in the coming years.

Swiss Watch Exports in 2024

Another indicator on the state of the watch industry is provided to us by the Federation of the Swiss Watch Industry, which recently released its complete 2024 figures.

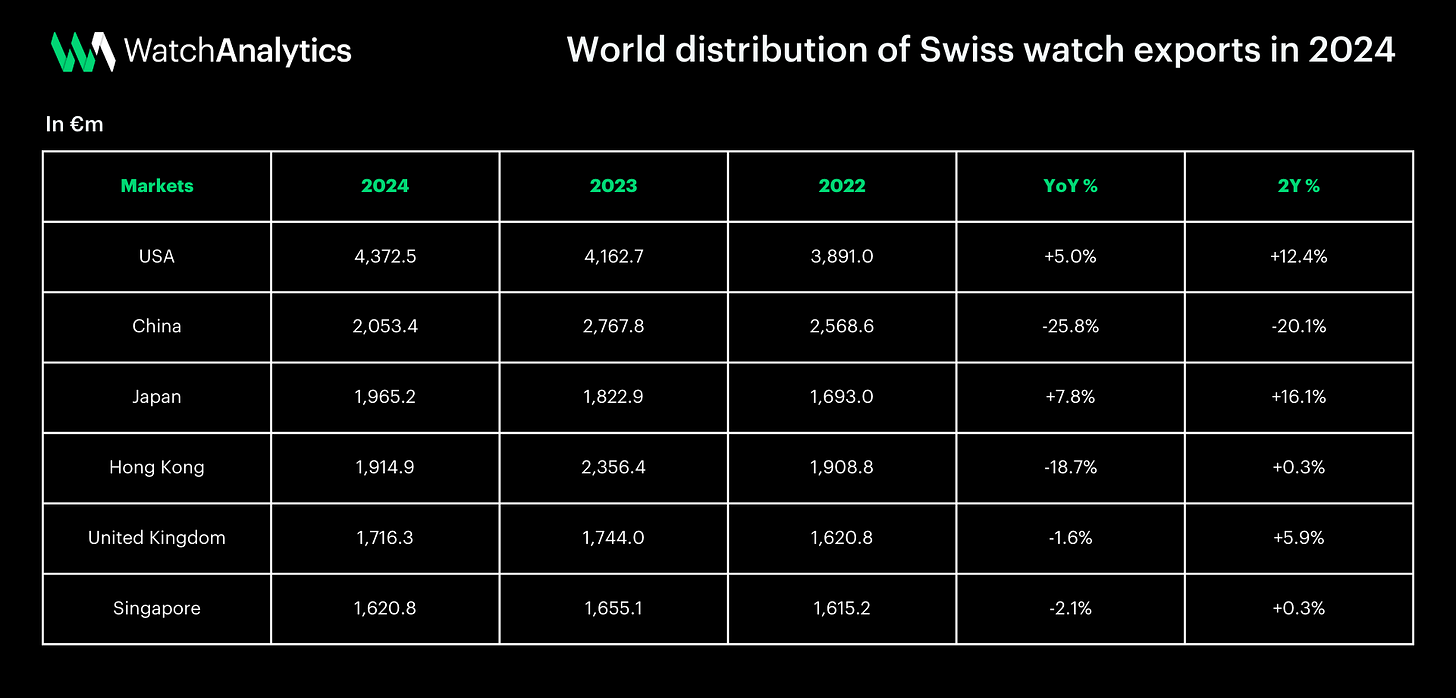

December maintained the negative trend of previous months, Swiss watch exports contracted significantly, falling -5.4% to a total value of 2.0 billion francs. On a year-on-year basis, the industry ended 2024 with a total of 25.9 billion francs, marking a decline of 2.8% compared to 2023.

In terms of volume, on the other hand, the total number of exported watches stood at 5.4 million units, confirming the decline in volumes (down 14.5%) and reflecting the industry's trend toward lower quantities in favor of higher prices.

Geographically, the U.S. market continues to show a positive trend (+5%), supported by the luxury boom. Japan also shows solid growth (+7.8%), boosted by an advantageous currency exchange rate and increased tourism activity. In Europe, the sector remains essentially stable (-0.1%). In contrast, exports to China (-25.8%) and Hong Kong (-18.7%) contract sharply. Finally, India confirms its rapid expansion in the luxury segment, with significant growth in exports (+25.2%).

Final Thoughts

The year 2024 proved to be a complex one for luxury watchmaking, with Swatch Group suffering a sharp drop in profits, LVMH reporting a slight decline in the watch and jewelry segment, and exports falling after years of record highs.

The crucial factor as we have come to realize, will be China; we shall see if 2025 brings changes for Asia's economic engine.