Swiss Watch Industry in Q1: LVMH Holds, Swatch Raises Prices, WoS Restructures

Exports rebound in March, but the industry faces shrinking Chinese demand, rising U.S. tariffs, and strategic store closures despite steady demand in key Western markets

Back in February, we commented on the promising performance of Swiss watch exports and wondered whether 2025 could be a strong year for the industry. However, the tariff war is increasingly disrupting the delicate balance within the watchmaking sector, making the future even more uncertain.

Swiss Watch Exports in March 2025

According to the FHS report released a few days ago, exports returned to growth in March with a +1.5% increase. However, the first quarter of 2025 still ended in negative territory, with a -1.1% drop compared to the same period in 2024.

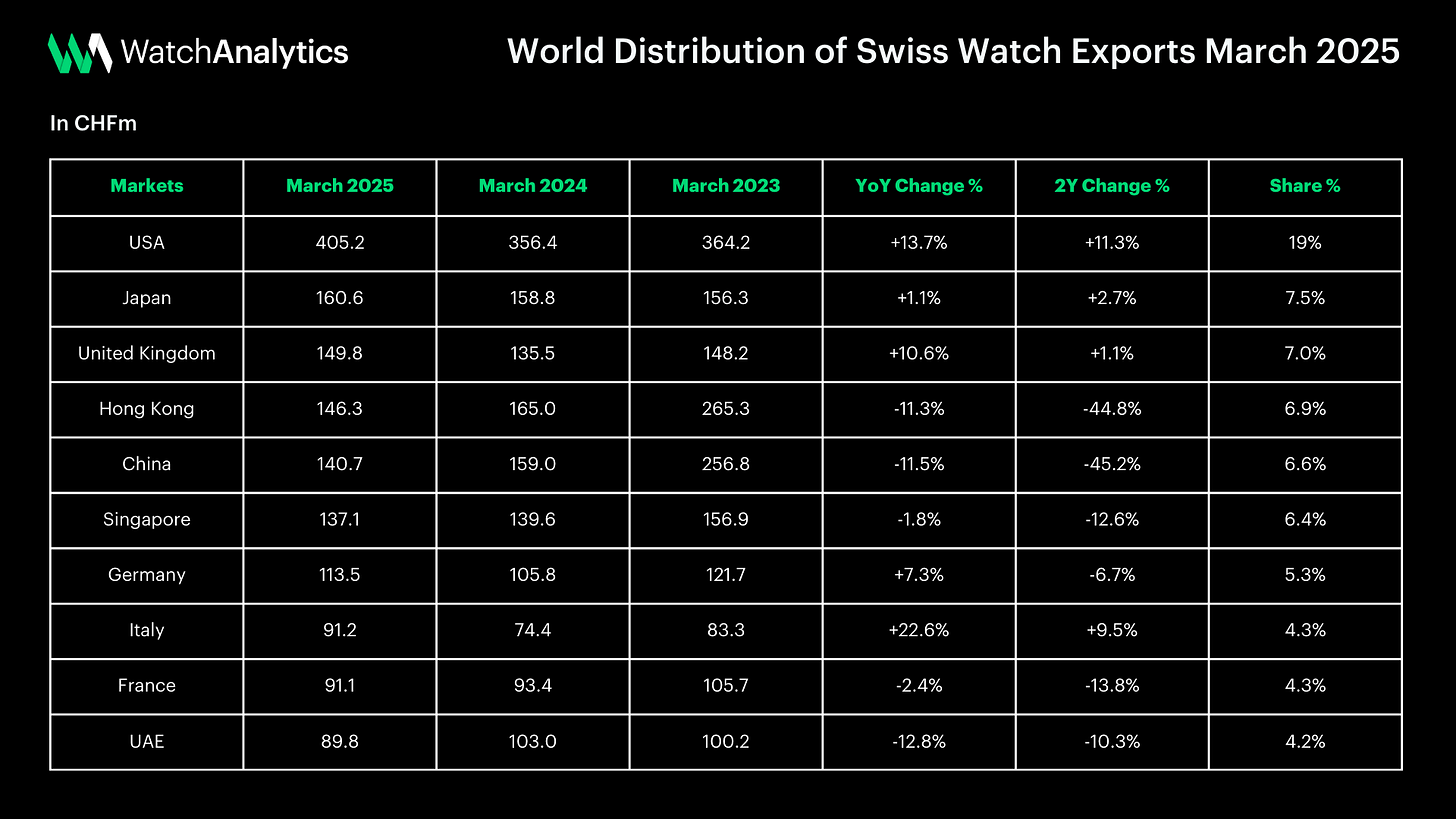

Geographically, the United States remains the most dynamic market, with a +13.7% increase in March. The United Kingdom (+10.6%) and Japan (+1.1%) also showed positive signs. China and Hong Kong, on the other hand, continued to decline, though the contraction has slowed somewhat, at -11.5% and -11.3% respectively.

While the Asian downturn is largely driven by Chinese restrictions on foreign luxury goods, the recent boom in U.S. demand is now seriously threatened, this time by tariffs imposed by the Trump administration.

The introduction of a 10% tariff on Swiss watch imports into the U.S. (up from the previous 3%), combined with the continued appreciation of the Swiss franc, poses a serious threat to the industry.

Swatch Group: Price Increases in the U.S.

In this context, Swatch Group was the first major player to react, announcing another round of price increases for its brands in the American market—the second since the beginning of the year.

According to reports, the decision was driven by two main factors: the depreciation of the U.S. dollar against the Swiss franc (nearly -8% in one month), and the introduction of the 10% tariff. Some of the group’s brands, such as Blancpain and Glashütte, have already implemented price increases ranging from 7% to 10%.

So far, Richemont, LVMH, and Rolex have maintained a wait-and-see approach, but similar moves may be on the horizon, unless there is an unlikely reversal in currency trends or a last-minute policy shift on tariffs by Trump.

LVMH Q1 2025 Results

LVMH's quarterly results, released this week, also offer an interesting insight into the state of the industry. The French luxury giant reported a 3% drop in total revenue in Q1 2025 compared to the same period in 2024. Yet the Watches & Jewelry division held up surprisingly well, with sales stable at €2,178 million, in line with last year.

LVMH does not provide a geographical breakdown for the segment, but reports a slight decline in the US and Japan. Given the current context: duties, currency, declining Chinese demand, maintaining volumes is a positive sign.

Watches of Switzerland chiude 16 negozi

Finally, Another headline-grabbing development in recent days was the decision by Watches of Switzerland to close 16 shops in the UK. These included flagship boutiques of Breitling, Omega, TAG Heuer and Hublot.

Despite the apparent severity of the measure, the company has made it clear that this is a rationalisation of the network, with the aim of focusing on more profitable and prestigious locations. The company's long-term plan, which aims to exceed £3 billion in revenue by FY26, remains unchanged.

Final Thoughts

The first quarter paints the picture of an industry in the balance, on the one hand demand in key markets such as the US and Japan continues to support exports, on the other trade tensions, currency instability and the collapse of Chinese demand are posing challenging issues.

The Swatch Group's price increase may be just the first in a series, as larger groups prepare for a difficult year ahead. Uncertainty is high, but the foundations of the industry remain solid. As always, time will provide the answers.