The 2024 Market Performance: Trends and Insights

The year 2024 was a defining year for watchmaking, with the primary market slowing down and the secondary market continuing its path toward stabilization

Like last year, I decided to create an article that would summarize a bit of what happened during this year, especially from a market perspective, bringing you data and information on the primary and secondary markets.

Before we dive into the analysis, I want to thank all of our newsletter subscribers for the continued support and trust you have shown us. It is thanks to you that we can continue to tell the stories, evolutions and curiosities of such a fascinating industry.

For 2025, we have are working on many new things, we can't wait to show them to you!

Watch Industry and Swiss Exports Data

2023 had ended with an all-time high for Swiss watch exports, thanks to a 7.6% growth over the previous year, driven mainly by luxury segments and Asian markets. The result comes after a series of consistently growing years (except for 2020 slowed down due to Covid). In 2019 the figure stood at CHF 21.7 billion, in 2020 it was CHF 15.3, in 2021 CHF 22.3, and in 2022 it grew by 11.4% to a record CHF 24.8.

However, as early as the second half of last year, some initial fears were kindled as data showed a slight slowdown in growth.

In the first few months of 2024, this negative trend was increasingly confirmed: in February exports dropped -3.8% (compared to the same period in 2023), and in March there was a -16.1% slump, with a particularly strong impact in China (-41.5%) and Hong Kong (-44.2%). Markets such as the United States and Japan, on the other hand, showed positive data, but not enough to offset Asian losses.

The declining export figures were also reflected in the financial results of the major listed fashion houses. Swatch Group in its July 2024 interim results reported a -14.3% decline in sales due to reduced demand in China and Southeast Asia.

Richemont's interim figures, released in November, also continued to report a market contraction with a -17% decline in the watch segment, and especially a -28% decline in the Asia-Pacific region. These markets, which had driven growth between 2020 and 2023, have now entered a phase of stabilization or contraction, heavily affecting overall results.

However, not all industry players were affected equally. Watches of Switzerland, which operates mainly in Western markets, showed revenue growth of +3.2% in the first half of 2024, thanks to the success of the Rolex Certified Pre-Owned program. Markets such as the United States and Japan continue to offer positive signs, with stable or growing sales, showing that some areas are less vulnerable to the declines seen in Asia.

Looking at the chart that the Federation of the Swiss Watch Industry provides, regarding the export data available from January to November 2024 we see how China and Hong Kong are down sharply from the same values in 2022 and 2023.

The November report, the latest one available, shows that exports are worth a total of CHF 24 billion in these 11 months. The total annual figure will not be released until the end of January 2025, but already we can say that total exports in 2024 will most likely be similar to those in 2022. Since the monthly value of exports is around CHF 2.3/2.4 billion, the total figure will be about 2%-3% lower than the CHF 26.7 billion in 2023.

Secondary Market

As for the secondary market, 2024 was quite similar to 2023, with a process of slight price decline.

Our WA50 Index, which brings together the 50 most popular and influential models in the market, stood at €85,068 in January 2023, while in December 2023 it fell to €77,705, down -8.7%. The same figure in January 2024 stood at €73,159, falling to €69,798 this month, registering an annual decline of -4.6%.

While the market has therefore continued to decline this year we can say that it has done so less than last year and in fact in this case the decline was almost 4% less. If this pattern continues next year we can expect prices to stabilize sharply.

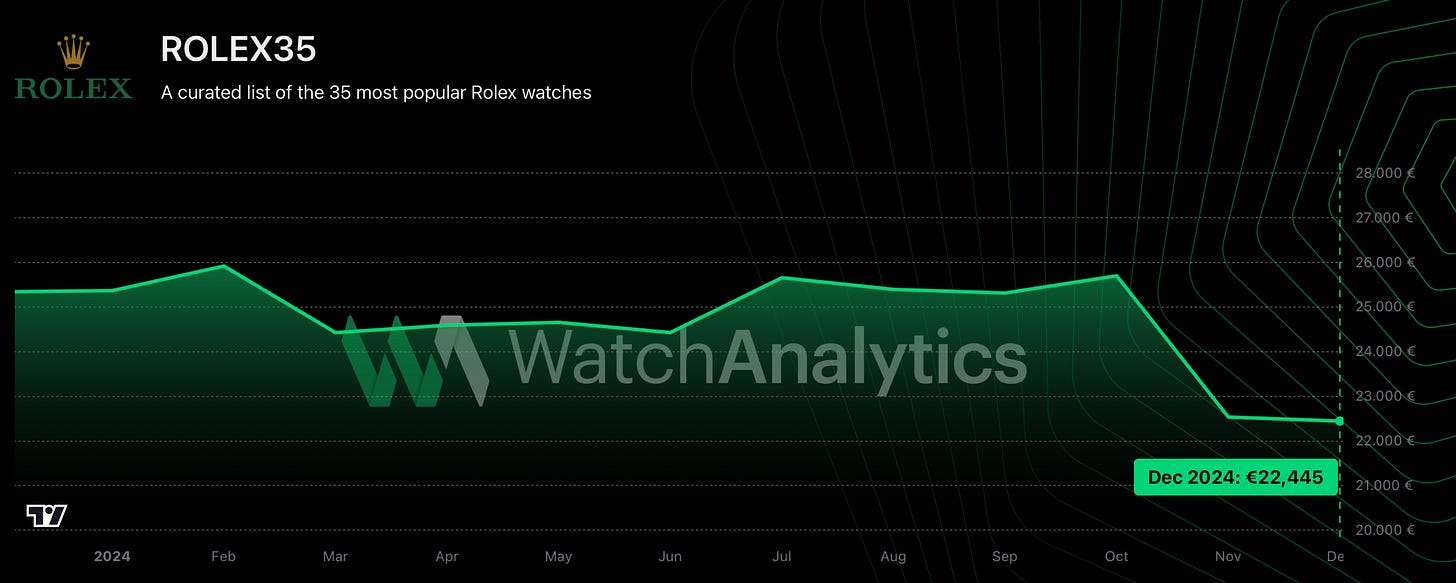

Instead, to understand how individual brands performed, we go, as usual, to analyze the dedicated indexes, starting with the number one brand by popularity: Rolex.

Rolex Performance YTD

Like most brands, Rolex also recorded declining figures, what is surprising is that the performance is worse than that tracked by the market in general that we observed with WA50. In fact Rolex35 went from €25,368 to €22,445, marking a decrease of -11.5%.

Weighing negatively on the index are the classic sports models, such as Submariner, Daytona, GMT, and Explorer for which many references recorded declines of as much as -12%/-14%. To understand in more detail what happened it is useful to dwell on the trend of the Daytona 116500LN-0001, to date it is the most popular modern Rolex on the market.

The Daytona “Panda” this month recorded its lowest value this year, dropping to €26,224 and registering a -12.76% decline from the previous year.

The worst decline, however, came from the GMT "Batman" 126710BLNR-0002, which registered a -28.58%, mainly due to a slump between February and April. On the other hand, the price of the GMT "Pepsi" 126710BLRO-0001 remains unchanged, as Rolex's difficulty in producing the bezel makes these models extremely rare. In addition, the rumor of an imminent production exit constantly hovers.

Among the top performers, however, we find the Daytona "John Mayer" 116508-0013, which saw its resell price rise +1.52%. This trend is due to the watch's production exit during Watches & Wonders, which is why since April the price has spiked to a high of €78,747. The slump in recent months was not enough to cancel out the growth of the previous period.

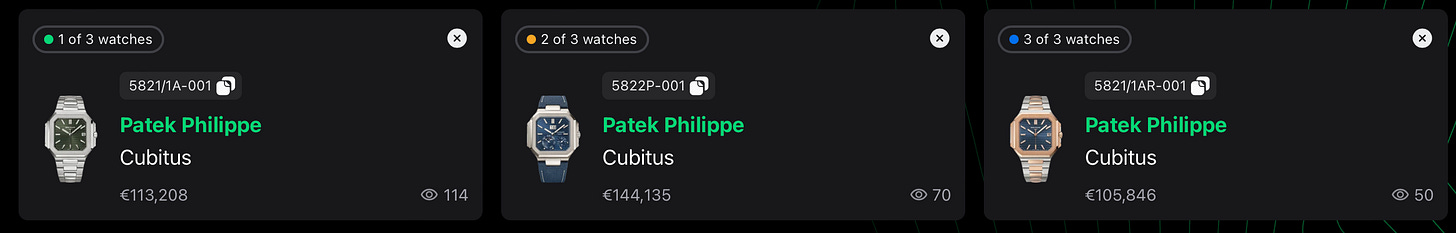

Patek Philippe and Audemars Piguet

Although the last period has highlighted the different approach to watchmaking by these two maisons, suffice it to note how PP has treated the Cubitus launch process “conservatively” and at the opposite AP has continued to produce out-of-the-box editions such as the one a few weeks ago with the designer KAWS, these two brands are united by many things, first and foremost their flagship watch.

The 2024 for the market's most influential Nautilus 15 was slightly lower than the rest of the market, in January 2024 the index price was €136,804, while this month it fell to €132,834, registering a -2.9% decline.

As for Audemars on the other hand, the RoyalOak15 Index, opened the year with a price of €127,768 and closed it at €122,046, registering a -4.5%, slightly higher than the other iconic Gerald Genta watch.

To conclude this analysis, we could not fail to mention the Cubitus, the most important release of the entire 2024. The long-awaited new model from Patek very few days after the launch was already available on the secondary market at prices, as usual, stellar compared to its list price. After a short while the price started to drop and now they are respectively at €113.208 for the 5821/1A-001 (+172.27% over list price), €144,135 for the 5822P-001 (+61.77%) and €105,846 for the 5821/1AR-001 (+71.33%).

Final Thoughts

The scenario traced by the watch industry is rather complex, as for the first time in a long time there is a reversal of the trend for the primary market, with brands that after several years of growth are now facing declining figures, mainly due to the difficult situation between China and Hong Kong.

On the other hand, the secondary market, which has seen a sharp decline in business over the past two years, has continued to decline albeit at lower rates than in previous years.

The question in 2025 will be whether the maisons will be able to cope with the difficult period and whether these problems will also be reflected in the secondary market.

As we have done for the past five years, we will be ready to keep you updated!